Can you imagine yourself buying a new laptop or smartphone and paying for it in cash? Even if you can, do you feel safe bringing cold cash inside your bag and walking around the mall with it? Definitely not.

Unfortunately, you don’t have a credit card that allows you to pay for your items even without bringing the cash with you. Or let’s say you want to extend payment terms, credit card is still necessary to enjoy Buy Now, Pay Later scheme.

Until fin-tech companies came into picture. Even without a credit card, you can pay for your items on a staggered basis.

Before you get excited, here are frequently asked questions about Buy Now, Pay Later or BNPL.

What is BNPL?

Buy Now, Pay Later is a payment scheme offered by fin-tech companies like BillEase and TendoPay. Through this scheme, you can purchase items and have it delivered to your doorstep while paying for the given amount on installment.

For BNPL, take note that Loan Contract will also be sent to you. Make a list of your payment schedule to make sure you won’t miss the due date.

How much can I borrow?

This depends on the lender. You can borrow from P1,000 to as much as P50,000.

Take note that for first time borrowers, most lenders won’t give you the maximum amount. You can start with P5,000 and could go higher depending on your payment behavior. If you pay on time and in full, then there is a higher possibility that you can get an increase in your credit limit.

What about interest rate?

This will also depend again on the lender. So far, BillEase offers the lowest interest rate at 2.49 percent. Some lenders could go as high as 4 or 5 percent.

What are the available loan terms?

You can pay for your loan anytime between 30 to 90 days. There are lenders that also offer up to 6 months.

How can I repay my installments?

There are several ways to pay for the amount you borrowed. Payment channels include but not limited to:

- GCash

- PayMaya

- Bank transfer

- 7/11

- Remittance centers like Cebuana Lhuillier

- Bills Payment counters in SM and Robinson’s malls

- Bayad Center

- LBC

- ECPay

Can anyone apply?

Yes, as long as you are of legal age (above 18 years of age) and you can show proof of your capacity to pay. Freelancers are likewise welcome to avail of the BNPL scheme.

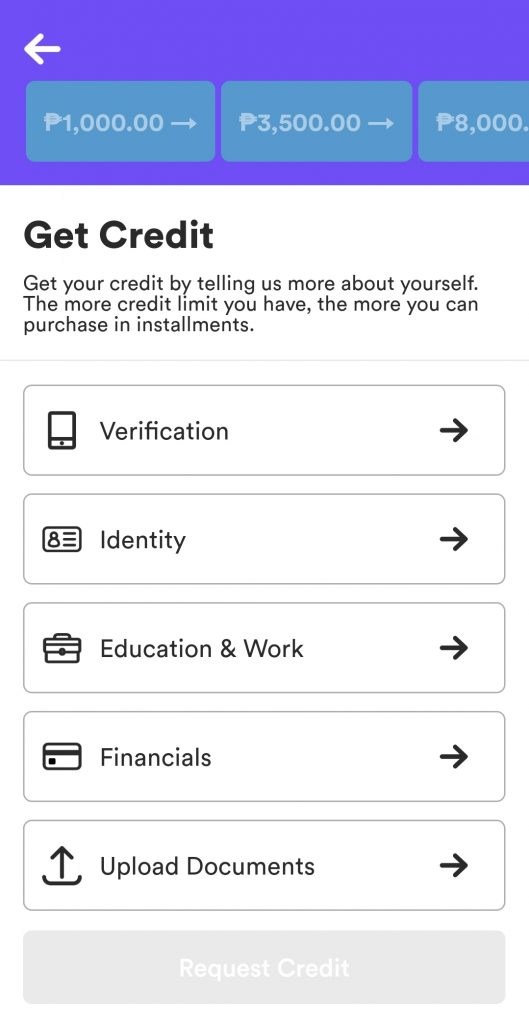

How can I apply?

Application process varies per lender. Still, one thing is for sure: everything happens online.

You can click the links to find out how to apply per lender:

How long does the approval process take?

It could take within minutes up to one day. Make sure you submitted all requirements to facilitate faster approval. It is also recommended that you apply on weekdays since most fin-tech companies don’t process loan application on weekends.

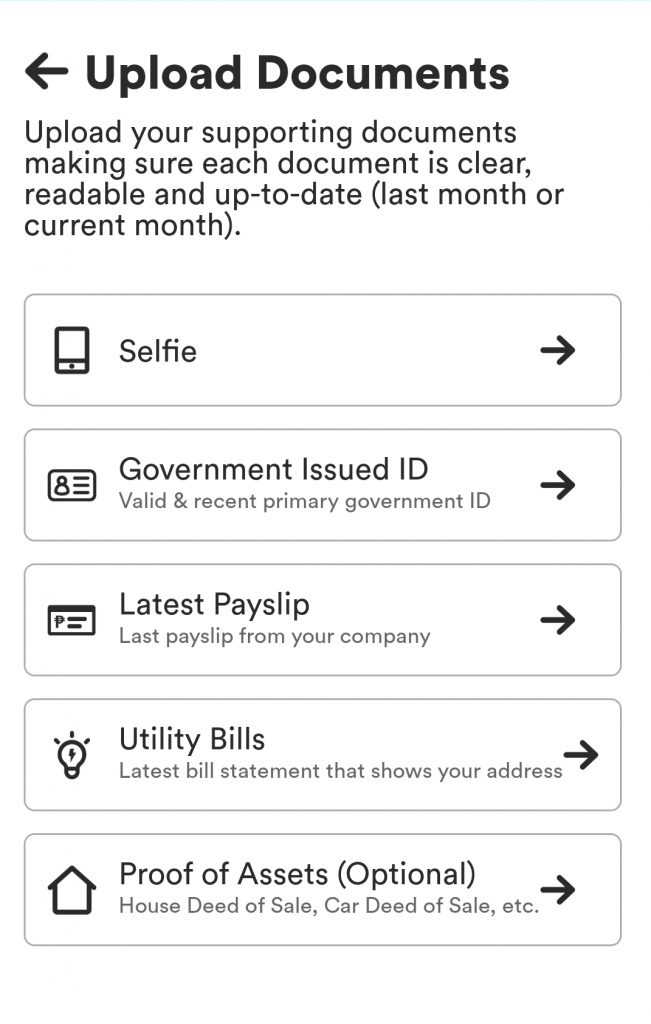

What documents do I have to submit?

This varies from lender-to-lender. To be sure, make sure you have the following minimum requirements:

- Government-issued ID like passport, driver’s license, and SSS ID

- Proof of billing to prove the validity of your address

- Latest payslip, which shows your capacity to pay

Do I need someone to guarantee my loan?

No. Unlike home and auto loans, BNPL has smaller amount; hence a guarantor is no longer required. This is why a copy of your payslip is a must to show that you are capable of paying your loan.

What other fees do I have to pay for aside from the interest?

Most fin-tech companies with BNPL don’t charge upfront fees like processing fee, although there are some that do. Generally, you will only be charged with interest rate every month.

Is the loan amount given in full?

Yes. Even if the payment is installment, the amount will be credited to your account in full.

How can I get my money?

Take note that in the BNPL scheme, you won’t physically hold the money. The amount will be credited to your account digitally, depending on where you will use the money.

There are several ways to get the amount borrowed. This includes:

- Lazada wallet

- Shopee wallet, which is currently offered by BillEase

- GCash account

The amount borrowed may also be credited directly to the merchant. Your obligation at that point is to pay the lender.

What happens if I can’t pay on time?

This is not recommended. A loan is still a loan even if you didn’t borrow from traditional banks.

In case you can’t pay on time, inform your lender right away. This way, you can discuss and negotiate possible options on how to pay your loan even if it’s already due. Otherwise, you’ll end up paying for interest fee and penalty fee, which is charged per day of non-payment. Worse, it could have an adverse effect on your credit standing.

Where can I shop?

Many online merchants are offering BNPL as a payment option. This includes Linen & Homes, Monarc, and Henry’s Camera among others.

To make this payment scheme easier, you can check out Lazada. BNPL through Lazada Loans allows consumers to shop and pay for their items on an installment basis.

Got more questions? Leave a comment on the comments section below and we will do our best to answer your concerns.

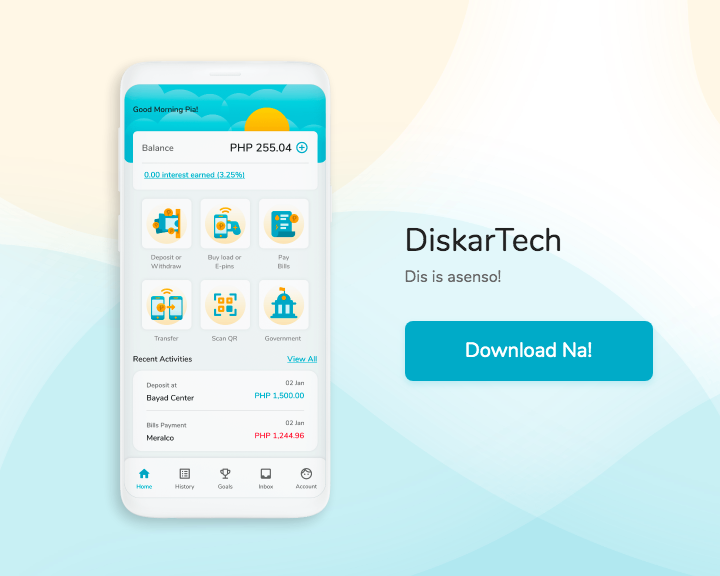

DiskarTech is the Philippines’ first “all-in-one Taglish inclusion super app.” Its primary purpose is to provide, among others, banking services for unbanked and underserved Filipinos, especially those in the grassroots communities.

DiskarTech is the Philippines’ first “all-in-one Taglish inclusion super app.” Its primary purpose is to provide, among others, banking services for unbanked and underserved Filipinos, especially those in the grassroots communities.

Recent Comments