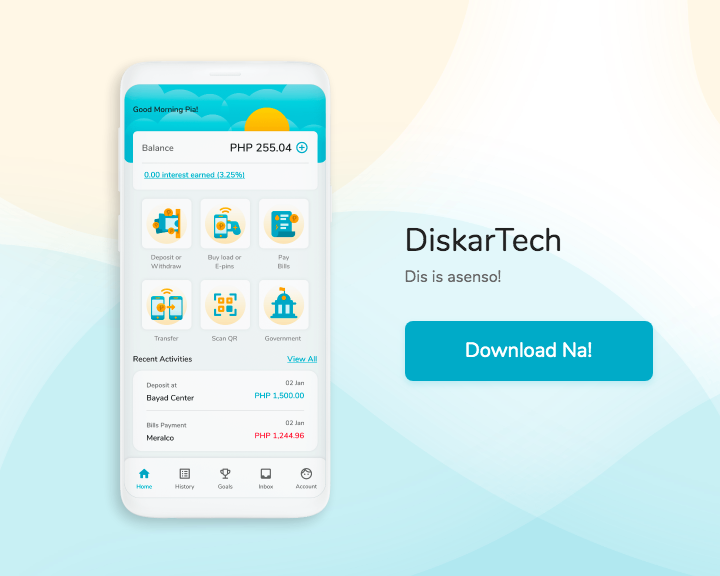

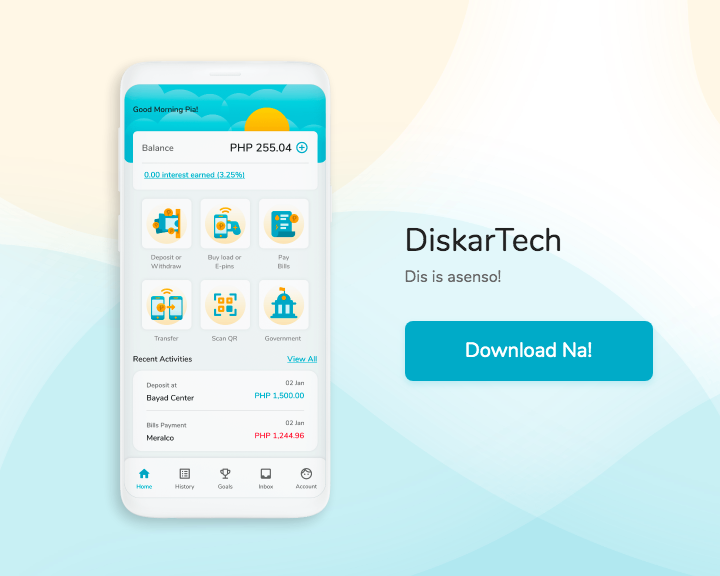

DiskarTech: Your One-Stop For Everything Digital

A lot of things have changed since the pandemic started. To minimize the possibility of getting exposed to the coronavirus, more and more businesses and various institutions are bringing their products and services in the digital world.

In fact, digital banking is on the rise; thus making it easier and more convenient for people to transfer money from one bank to another, pay bills, and do online shopping among others.

In line with this trend, RCBC launched DiskarTech, the bank’s latest online platform aimed to target millions of unbanked Filipinos.

Getting To Know DiskarTech

DiskarTech is the Philippines’ first “all-in-one Taglish inclusion super app.” Its primary purpose is to provide, among others, banking services for unbanked and underserved Filipinos, especially those in the grassroots communities.

DiskarTech is the Philippines’ first “all-in-one Taglish inclusion super app.” Its primary purpose is to provide, among others, banking services for unbanked and underserved Filipinos, especially those in the grassroots communities.

Since the app is in Taglish, it will be easier for ordinary Filipinos to understand banking and financial terms. This will erase confusion and feeling of intimidation since people can easily understand the language.

More importantly, it is fully supported and commended by various government agencies including the Bangko Sentral ng Pilipinas and Department of Trade and Industry.

Features And Services

- Opening of deposit account, which does not require an initial amount or maintaining balance. This is easier and more convenient because it requires one-time registration via electronic know-your-customer (eKYC) digital process.

- Deposit and withdrawal facility in real time from partner channels like Bayad Center and 7-Eleven

- E-load

- Bills payment

- Fund transfer

- QR code transfer

- Payment of government fees / membership

- Telemedicine

- Loan and insurance application

- Additional income through its referral program where you can earn up to P30,000

Requirements:

- Filipino citizen

- At least 18 years old and above

- Government-issued ID such as driver’s license, passport, UMID, SSS ID, Postal ID, PRC ID

How to Register:

- Download the DiskarTech app in Google Play Store (Android users) or Apple Store (iPhone users).

- Launch the app and then click Gumawa ng Account to register.

- Input your username and mobile number. A one-time code will be sent so make sure to input it.

- Set your password to finish registration.

You might also be asked to set your goals. This is optional, although goal setting could help you focused and more serious when it comes to saving.

It is also recommended to upgrade your account. This allows you to enjoy up to 3.25 percent per annum, which is higher than most banks’ less than one percent. To upgrade, you will be asked to fill out several information about yourself such as name, email address, and address among others.

Why download DiskarTech?

Digital banking is on the rise these days. In fact, it makes our lives easier and more convenient since we could do transactions with just a few clicks and without leaving the house. To do digital banking, one must have a bank account first. To have a bank account, you need to submit a lot of documents.

This is why DiskarTech is reaching out. It aims to help millions of Filipinos who do not have access to what banks offer. This includes the working class from C, D, and E income segments who are often not given priority. This will also benefit micro, small, and medium enterprises, including sari-sari store owners and market vendors.

This will help “level the playing field” by giving the underbanked opportunities for financial growth. For RCBC, financial inclusion is a must and no one must be left behind.

DiskarTech is the Philippines’ first “all-in-one Taglish inclusion super app.” Its primary purpose is to provide, among others, banking services for unbanked and underserved Filipinos, especially those in the grassroots communities.

DiskarTech is the Philippines’ first “all-in-one Taglish inclusion super app.” Its primary purpose is to provide, among others, banking services for unbanked and underserved Filipinos, especially those in the grassroots communities.