Lazada has been a go-to place for many online shoppers. It has everything you need from the smallest items to the biggest, hard-to-find products, and even food and grocery. It became a hub for online sellers to extend their market reach to be able to provide products that will make every consumer life’s easier.

But of course, it doesn’t stop there. Buying something from Lazada means paying for the items as well.

Thankfully, Lazada offers tons of payment methods to make payment easier and more convenient. Apart from bank transfer and cash on delivery, Lazada partnered with several financial merchants to offer Lazada Loans. This means you can now apply for a loan to pay for your purchases and pay for this on installment even without a credit card.

Yes, you read that right. You can stretch payment terms and pay on equal installments even if you are not a credit card holder. This was made possible through Lazada Loans.

Below are the frequently asked questions about this service from Lazada:

What is Lazada Loan?

Popularly known as “Buy Now, Pay Later,” this service from Lazada allows customers to show now and pay for their purchases on installment. This service is “outsourced” by Lazada, which means you have to apply with any of Lazada’s accredited partners.

As of this writing, you can apply with BillEase, TendoPay, Cashalo, and Paylater among others.

Where can I apply?

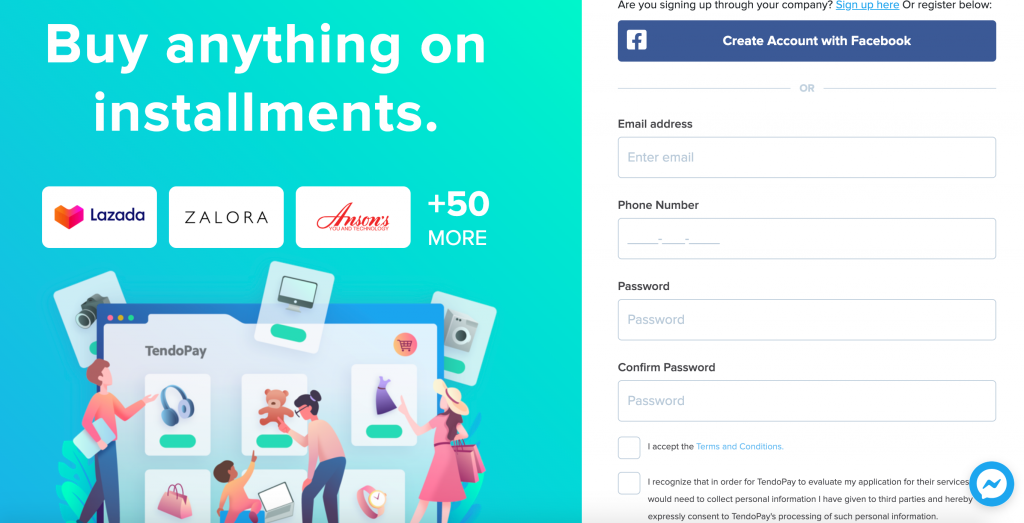

You can apply either via desktop or through app. Either way, make sure you have a copy of basic requirements such as government-issued ID, proof of billing, and income documents such as payslip so make sure you have them on hand.

How much can I borrow?

This varies per lender. Nevertheless, first-time borrowers could be borrow as much as P4,000. Depending on your payment behavior, the maximum loan amount can be higher and up to P50,000.

How long do I have to wait?

This will depend per lender since some could approve (or deny) your loan application few minutes after submission. Nonetheless, expect the application process to go as long as 24 hours.

This is why it is important to submit all necessary documents and fill out the information sheet as truthfully as possible. This will make it easier for the lenders to assess your financial standing.

Are there any special offers when I apply for a Lazada loan?

This varies per lender as well. Some lenders offer zero percent interest-free loan for first-time customers to entice you to apply.

How much is the interest rate?

Again, this depends on the lender. So far, lenders offer an interest rate between two and four percent.

How can I get my money?

You cannot physically withdraw the amount you borrowed. Once approved, the amount will be credited directly in your Lazada wallet, which is also the only disbursement channel. Upon credit, you can use the Lazada wallet to pay for your items upon checkout.

Make sure your Lazada wallet is activated before you apply for a loan.

How long will it take for the amount to be credited in my Lazada wallet?

This depends on when you submitted your application form. If you applied between Monday and Friday, then you will receive the money within a few hours to maximum of 24 hours upon approval.

If you applied on a weekend, then the amount will be credited by Monday afternoon since crediting is done on business days only.

Either way, you will receive a notification via SMS and through the Lazada app once the funds are transferred in your Lazada wallet.

Will I get the amount in full?

Of course! Even if the payment scheme is installment, you will still get the amount you borrowed in full.

What can I buy?

Anything. Lazada is home to thousands of products, so go ahead and browse. Upon payment, don’t forget to use your Lazada wallet and

What happens if my loan application was rejected?

That’s fine. You can freely apply with other lenders in case your loan application was rejected.

Just make sure you’ll look into the lender first to find out which among them is best suitable for your needs?

Can I apply with different lenders at the same time?

Yes. You can get one loan at a time per lender, especially if you will need a higher amount.

Although possible, we do not strongly recommend this since multiple loans means you need to handle more than one loan with different rates and terms. As much as possible, stick to one or two loans. Once you paid them off, then apply for a new one.

I forgot to use the credits in my Lazada Wallet. Do I still have to pay for the loan?

Unfortunately, yes. In fact, you will have to start repaying your loan according to the repayment schedule given by your lender, regardless if you finished the entire amount or not. The amount was already credited to your account, so the assumption is you already used those credits.

Do wallet credits expire?

The good news is no.You have the option to use the credits anytime you want or save it for later and then apply for another loan for bigger credits.

What if the credits in your Lazada wallet is not enough?

That’s fine. You can apply for another loan from another lender to get higher credits. Or you can also top up your wallet through various Cash In methods like bank transfer, debit card, or GCash. This way, you don’t have to borrow money and reduce your exposure.

How can I repay?

Every lender has their own repayment channels. In fact, Lazada has nothing to do with repayment anymore since it was already paid by the lender.

Each lender has several repayment options including bank-to-bank transfer, GCash, or bills payment center among others. Take note of the repayment procedure before you click the “Submit” button and make sure to make a list. This way, you won’t forget your scheduled payments and you won’t also compromise your chances of getting a higher loan.

Is Lazada Loan safe?

Yes. Lazada partnered with some of the best and legitimate BNPL providers to ensure that the customers’ information are safe.

What is TendoPay?

What is TendoPay?

Recent Comments