Recent Posts

Tag Cloud

Akulaku

Availa

Bank Loan

BillEase

Binixo

Business Loans

Cashalo

Cash Mart

Cashwagon

Comparison

Credit24

Doctor Cash

Dr Cash

Esquire

First Circle

First Circle Review

Home Credit

Home Credit Philippines Review

How to apply

Installment plan

Lazada

Lazada Installment Plan

Lendr

Loanranger

Loan Ranger

Moola

My Cash

Online Cash

Online Cash Loan

Online Loan

Online Personal Loan

PAG-IBIG

PAG-IBIG Multi-Purpose Loan

Pera247

Personal Loan

Quickpera

Review

Robocash

SALAD

Security Bank

SSS Loan

SSS Salary Loan

Tala

Tala Loan

Tala Philippines

Recent Comments

- loans on Home Credit Review: What Customers Have to Say About It

- loans on Get an Installment Plan for Your Lazada Purchase with the Help of BillEase

- loans on Home Credit Review: What Customers Have to Say About It

- Nick on Home Credit Review: What Customers Have to Say About It

- Michaela on Home Credit Review: What Customers Have to Say About It

Archives

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- February 2020

- October 2019

- September 2019

- June 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- February 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- February 2017

Categories

- Aeon Philippines

- Akulaku

- Atome (Kredit Pintar)

- BillEase

- Business Loans

- Cash Mart

- Cashalo

- Cashwagon

- Credit24

- DiskarTech

- Esquire Financing

- First Circle

- Home Credit

- Jungle

- Lazada Loans

- Lendr

- Loan Ranger

- Moola Lending

- Online Cash Loans

- Pag Ibig

- Paylater

- Pera247

- PeraJet

- Personal Loan

- PondoPeso

- Robocash

- Security Bank

- Shop Now, Pay Later

- SSS Loan

- Tala Philippines

- TendoPay

- UnaPay

- Uncategorized

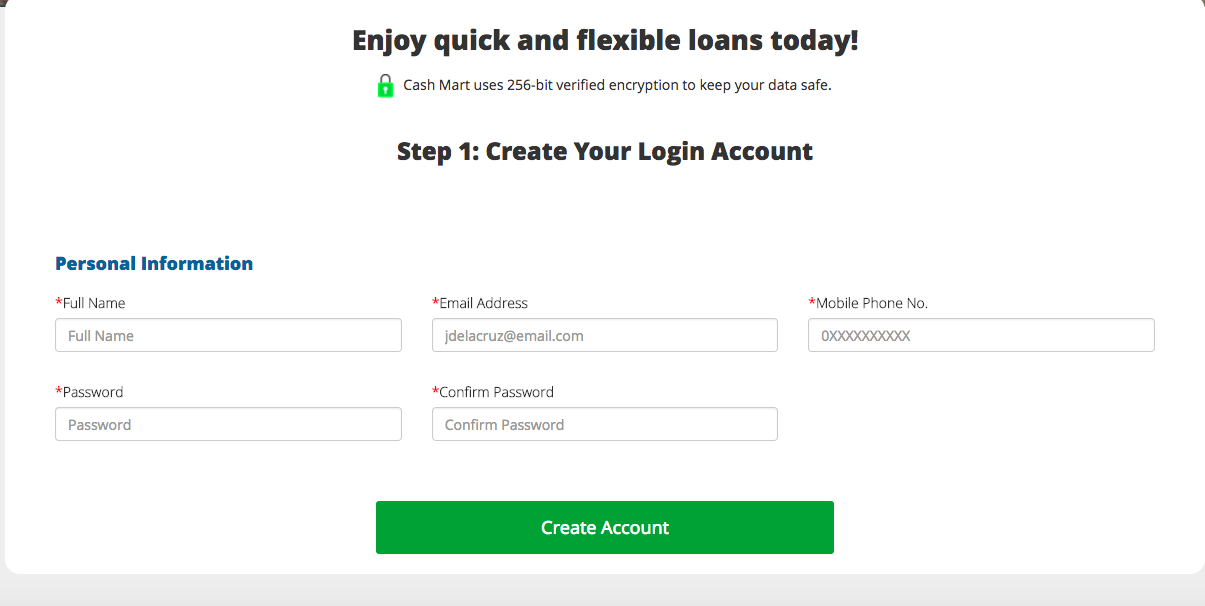

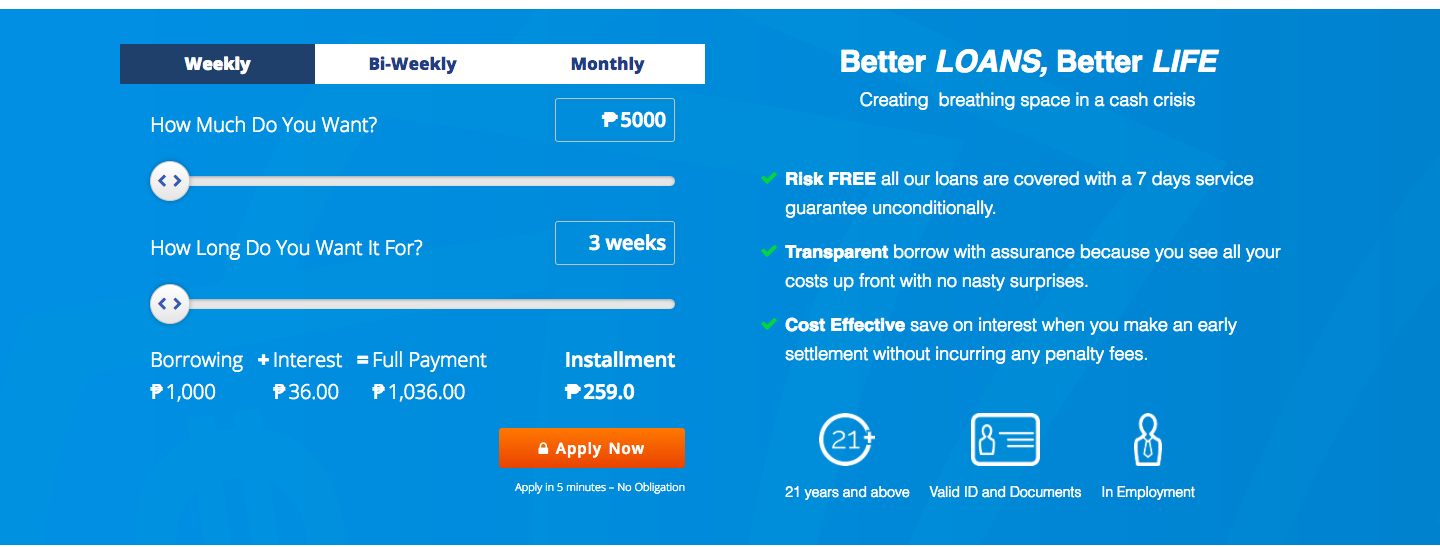

Here’s how you can apply for a loan:

Here’s how you can apply for a loan:

hi?

Pwde po ba kahit kung walang bank account ?

Hi Juno! Cash Mart requires a bank account since that is where they will credit the loan amount 🙂 You can consider other online lenders like Tala or Loan Ranger who are more flexible in terms of loan credit 🙂

hello sir, bakit po ganun yung account ko sa cash mart puro updating lang po,

Hi Jeff. It’s possible po that their system is down. You could call them po at (02) 829 0000. Thanks!

good day, i’m asking for a help how can i pay tala without my cellphone? accidentally, nahulog po yung bag ko sa baha kasama yung phone ko kaya po hindi ko alam kung sa paanong paraan ako makaka connect sa tala to pay my balance thank you.

Hi there! You can pay through various remittance centers or sa 7/11. Take note of the reference number given to you by Tala (they should send it also in the email address you used when you register) when making payments. Thanks!

I cant access cashmart on my phone even on desktop pc. Whenever I visit cashmart page and click login,it will direct you to other tab. Once youre login, I cant find loan details, Its just your profile editing..

Hello Jeniffer. Perhaps, their system is down? If you need to borrow from Cashmart, you may call them at (02) 829 0000 so they could further assist you.