Recent Posts

Tag Cloud

Akulaku

Availa

Bank Loan

BillEase

Binixo

Business Loans

Cashalo

Cash Mart

Cashwagon

Comparison

Credit24

Doctor Cash

Dr Cash

Esquire

First Circle

First Circle Review

Home Credit

Home Credit Philippines Review

How to apply

Installment plan

Lazada

Lazada Installment Plan

Lendr

Loanranger

Loan Ranger

Moola

My Cash

Online Cash

Online Cash Loan

Online Loan

Online Personal Loan

PAG-IBIG

PAG-IBIG Multi-Purpose Loan

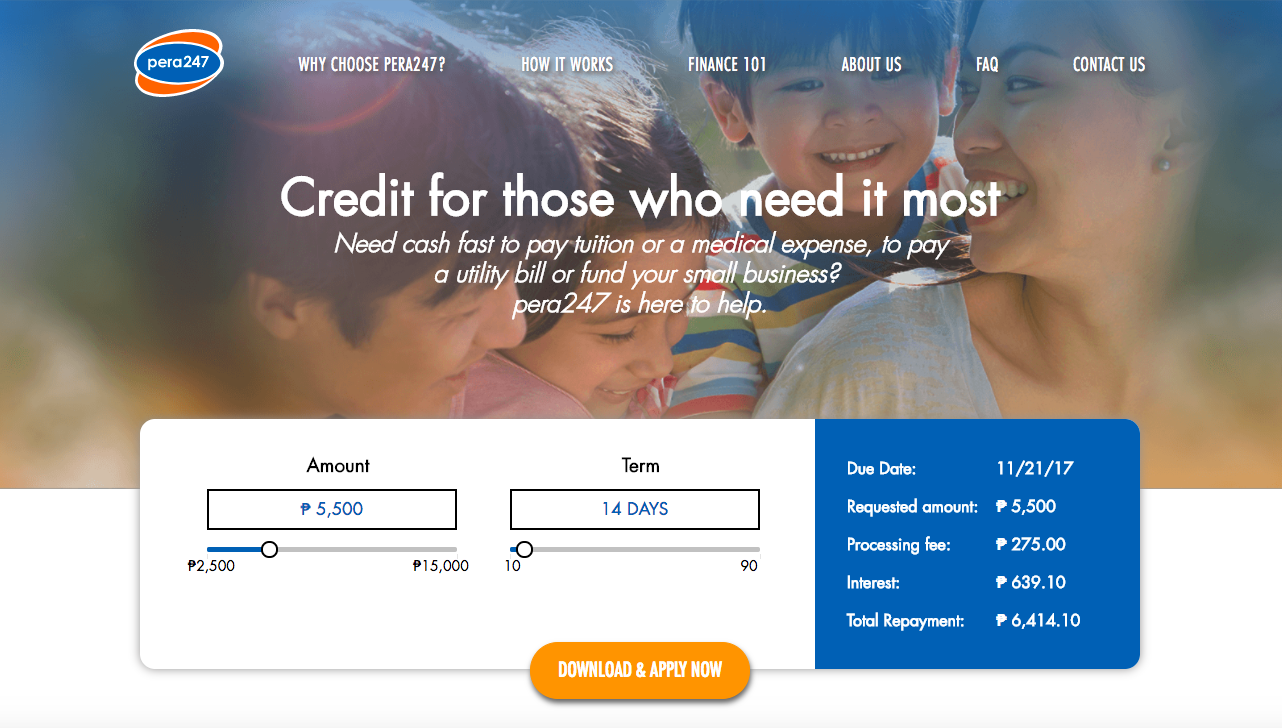

Pera247

Personal Loan

Quickpera

Review

Robocash

SALAD

Security Bank

SSS Loan

SSS Salary Loan

Tala

Tala Loan

Tala Philippines

Recent Comments

- loans on Home Credit Review: What Customers Have to Say About It

- loans on Get an Installment Plan for Your Lazada Purchase with the Help of BillEase

- loans on Home Credit Review: What Customers Have to Say About It

- Nick on Home Credit Review: What Customers Have to Say About It

- Michaela on Home Credit Review: What Customers Have to Say About It

Archives

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- February 2020

- October 2019

- September 2019

- June 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- February 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- February 2017

Categories

- Aeon Philippines

- Akulaku

- Atome (Kredit Pintar)

- BillEase

- Business Loans

- Cash Mart

- Cashalo

- Cashwagon

- Credit24

- DiskarTech

- Esquire Financing

- First Circle

- Home Credit

- Jungle

- Lazada Loans

- Lendr

- Loan Ranger

- Moola Lending

- Online Cash Loans

- Pag Ibig

- Paylater

- Pera247

- PeraJet

- Personal Loan

- PondoPeso

- Robocash

- Security Bank

- Shop Now, Pay Later

- SSS Loan

- Tala Philippines

- TendoPay

- UnaPay

- Uncategorized

Who is pera247?

Who is pera247?

Hi. I shall lke to apply for a cash loan via AsiaKredit. Please advise how to proceed.

Thank you.

Hello there. Please download the app first at Google Play Store then follow the step-by-step procedure indicated in this post to start with your loan application.

Why is it taking too long for them to review the application? All the credentials pera247 asked from us aint that complicated. Im a lot more worried because pera247 have my personal info. I gave them my trust and they are not even giving me a call. How many are there reviewing the applications? one? three? five? cause the ad really failed to meet our expectation. processing isnt fast. we dont feel safe anymore. pera247 already defeated the purpose of emergency loan. mag apply kaya ako sa pera247 para ma tulungan din naman ang mga magrereview ng application.

Hello! We’re sorry that you feel this way towards Pera247. May we know if you have contacted them already? We want to help but we are not affiliated with them so we cannot check your account.

hi,

I apply last week and until now there is no one calling me for the status of my loan

Hi Darlyn,

unfortunately Pera247 does not list a phone number on their website. But you can try their contact page: http://pera247.ph/contact-us

or their facebook page: https://www.facebook.com/pera247/

All the best with your application!

Always connot process mga paasa kayo.

Hi Jane. We apologize for the inconvenience that Pera247 has caused you. We’re not sure about the loan processing criteria imposed by Pera 247. Perhaps, you can try other online cash lending companies such as Loan Ranger.

hi how many days is the approval?

Hello there. This would depend on Pera247 since they have their own procedure to follow when it comes to approving (or rejecting) loan applications. Nonetheless, the ideal processing of loan application is 24 hours or one day 🙂

Good day! What happen to your apps is there any problem? No one is calling and I email already but no feedback..thankyou

What if our utility bills are not named after me they are named to my parents

Hello Dhang. The utility bill is merely to check the legitimacy and existence of the address indicated in the loan application form. Thanks!

Hi shy apply for a cash loan

Hello po ask ko lang po gaano po katagal yung process at kailan po kaya ako possibble na matawagan?

Hi Floriza. They “promise” 24 hours, but loan processing could go beyond that, depending on the number of applications they review everyday 🙂

Sana magdagdag kayo ng lists of bank na pwede magamit for withdrawal gaya ng bdo,unionbankband bpi. Hindi ko nakita sa listahan ang mga bangko na ito. Pero salamat sa oag approved sa loan ko. Malaking tulong ito until i i get my salary.

Hi Jonalyn. Good to know that you had a pleasant experience with Pera247. Don’t worry. We’ll update this and inform Pera247 about your concern to help them improve their service 🙂

Your 24hr reply on loan application status is not true. It is better to tell whether the application is approve or not, than making the loan applicants expecting. Kaya nga nag-lloan sa inyo kasi nga emergency.. improve your uptime response.. thanks

Hi Hermo. We’re sorry to hear about this. Apparently, we are not Pera247 and rather an independent blog that features and reviews online cash lenders. Don’t worry. Perhaps Pera247 had to process a lot of loan applications but they will surely get back to you as soon as they can 🙂

Hi good day kakaaply ko pa lang po im new thats why i need to loan its because i will pay my daughter tuition fee so i can get her id i have allowance every month but i need urgent the money for my daughter school tuition fee sana po maapproved please po need ko lang po talaga

Hi good day kakaaply ko pa lang po im new thats why i need to loan its because i will pay my daughter tuition fee so i can get her school record and form 137 i have allowance every month but i need urgent the money for my daughter school tuition fee sana po maapproved please po need ko lang po talaga

Hi Rinalyn. We are not Pera247, so we cannot access your loan application. As long as you submitted the requirements and you have a good credit standing (meaning you paid your bills on time), then there is a chance naman po of approval 🙂

Bakit po ako may good credit standing pero decline sa 4th loan ko? Is that necessary? Inalagaan ko pa nman account ko sa pera247 kasi i like your policy in payment na pwede sya bayaran sa araw na gusto mo na bawas ang tubo.

Hi there! We’re sorry to hear about this experience. Have you contacted Pera247 regarding this? You can also consider other online cash lenders in case you need cash quick. Salamat!

Money unsuccessfully delivered 3 days na. Reloan lng po ito wala ng feedback

Hello Cheryl! Have you contacted Pera247 regarding this? You can send them an inquiry through their website – https://www.pera247.ph/contact-us Thanks!

Hi i applied today but i was not able to send utility bill..i am employed hoping that i will be given a chance for my first loan..thnks!

Hi Reine! Submission of complete requirements is highly recommended. Otherwise, there might be a delay in the application process or this could be a reason for disapproval. Thanks!

how long bago mareceive ung pin para dun sa 16 digit code?

Hi Anthony! You should receive it kaagad po. If wala po kayo natanggap, please contact them po through their Contact Page so they could check your account – https://pera247.ph/contact-us/

for fund withdrawal na po ako. pinili ko po securitybank wla kcng bpi s option ngtext n sb sken dun sa 16digit card pero yung sa pin wla pdin po.

Hello Jelina. Please contact Pera247 through their Contacts Page so they could check on your account – https://pera247.ph/contact-us/

Nag renew ako then approved the request ako ng cash out thru security bank egivecash. They send the card number and pin then I try to widraw it in security bank ATM yesterday the ATM Machine says the information entered is incorrect. Then at 1:00 AM today pera 247 text me I successfully recieved the loan. Ano to lokohan di ko naman na encash yung loan tapos pagbabayari. Nila ako tangina I will not pay that and I will never use this app .kinontak ko sila walang nag rereply kahit isa kahit si John Ramos yung collection agent.

hi sir/mam, ask lang po thru egive-cash po kasi yung claim ko ng loan approved,eh kelangan po ng passcode kayo po ba mag provide ng passcode ? thank you

Hi Ruth. We don’t provide the passcode po since we are not Pera247. Have you contacted them already regarding this?

https://pera247.ph/contact-us/

Up to now wala pa din yung ni loan. Ang sabi na deposit na sa account pero wala pa din. Tapos umaandar na interest. Hindi mo pa nagagamit tumutubo na agad.

Hi Jeffrey. You may coordinate with Pera247 regarding this para ma-check din po ang inyong account – https://pera247.ph/contact-us/

I am very disappointed been calling for almost a week now for my payment to be posted yet no update. I pay on time and all you do is call me regarding my payment which is not yet posted on your end. Have sent proof of payment via app and email it as well but still no progress. Would someone has solution for this aside from telling me over and over that it has been forwarded for posting yet days has passed by and still no payment was posted.

Hi Meryl. It’s possible that the payment did not automatically reflect on their system; hence the reply. We suggest that you keep a copy of your proof of payment so that they won’t charge you with interest and penalty fee anymore.

for a reloan. can we apply for a higher amount compare to previous loan and how long is the reloan process? thanks….

Hi Mark! You may try to apply for a higher amount, but this is still subject to review by the lender since they will be the one making the assessment 🙂