Recent Posts

Tag Cloud

Akulaku

Availa

Bank Loan

BillEase

Binixo

Business Loans

Cashalo

Cash Mart

Cashwagon

Comparison

Credit24

Doctor Cash

Dr Cash

Esquire

First Circle

First Circle Review

Home Credit

Home Credit Philippines Review

How to apply

Installment plan

Lazada

Lazada Installment Plan

Lendr

Loanranger

Loan Ranger

Moola

My Cash

Online Cash

Online Cash Loan

Online Loan

Online Personal Loan

PAG-IBIG

PAG-IBIG Multi-Purpose Loan

Pera247

Personal Loan

Quickpera

Review

Robocash

SALAD

Security Bank

SSS Loan

SSS Salary Loan

Tala

Tala Loan

Tala Philippines

Recent Comments

- loans on Home Credit Review: What Customers Have to Say About It

- loans on Get an Installment Plan for Your Lazada Purchase with the Help of BillEase

- loans on Home Credit Review: What Customers Have to Say About It

- Nick on Home Credit Review: What Customers Have to Say About It

- Michaela on Home Credit Review: What Customers Have to Say About It

Archives

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- February 2020

- October 2019

- September 2019

- June 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- February 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- February 2017

Categories

- Aeon Philippines

- Akulaku

- Atome (Kredit Pintar)

- BillEase

- Business Loans

- Cash Mart

- Cashalo

- Cashwagon

- Credit24

- DiskarTech

- Esquire Financing

- First Circle

- Home Credit

- Jungle

- Lazada Loans

- Lendr

- Loan Ranger

- Moola Lending

- Online Cash Loans

- Pag Ibig

- Paylater

- Pera247

- PeraJet

- Personal Loan

- PondoPeso

- Robocash

- Security Bank

- Shop Now, Pay Later

- SSS Loan

- Tala Philippines

- TendoPay

- UnaPay

- Uncategorized

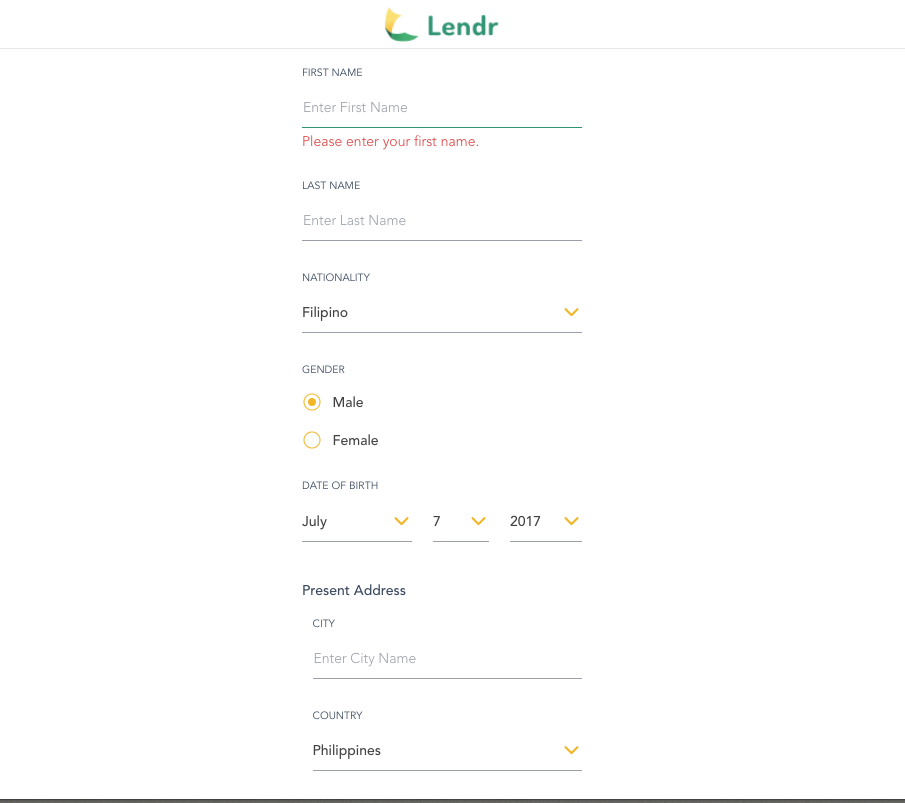

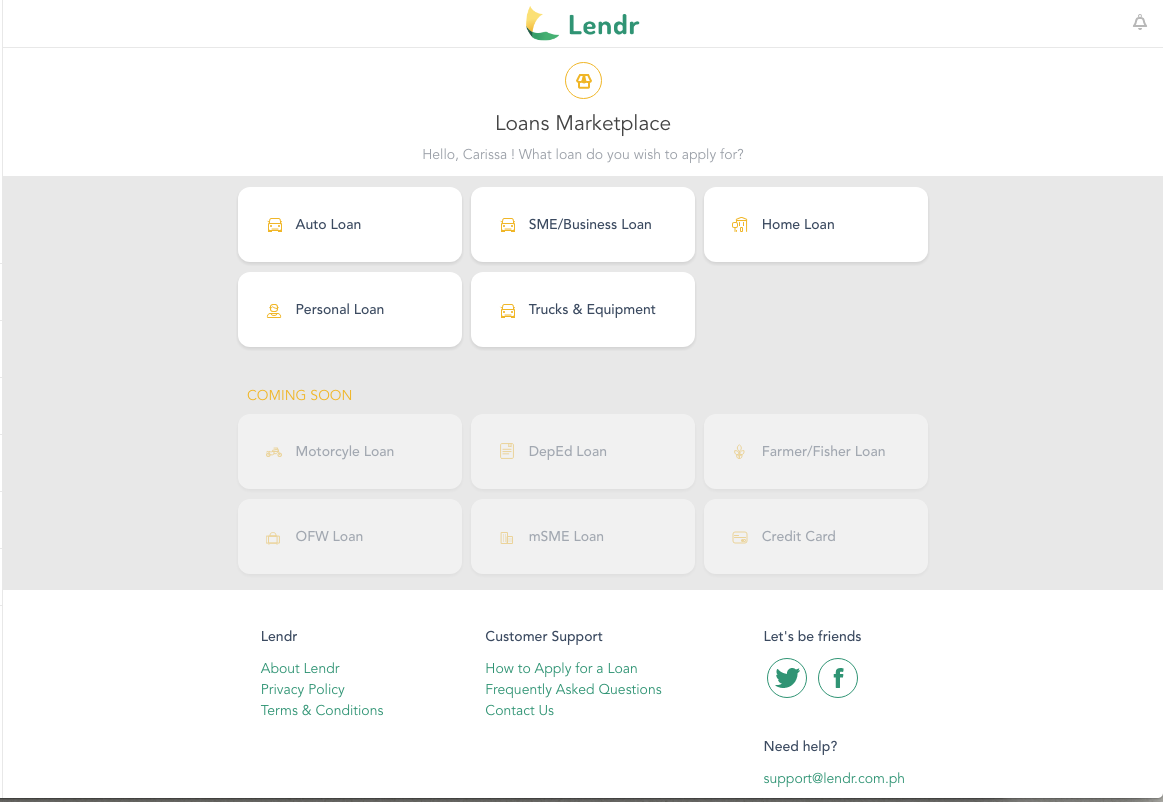

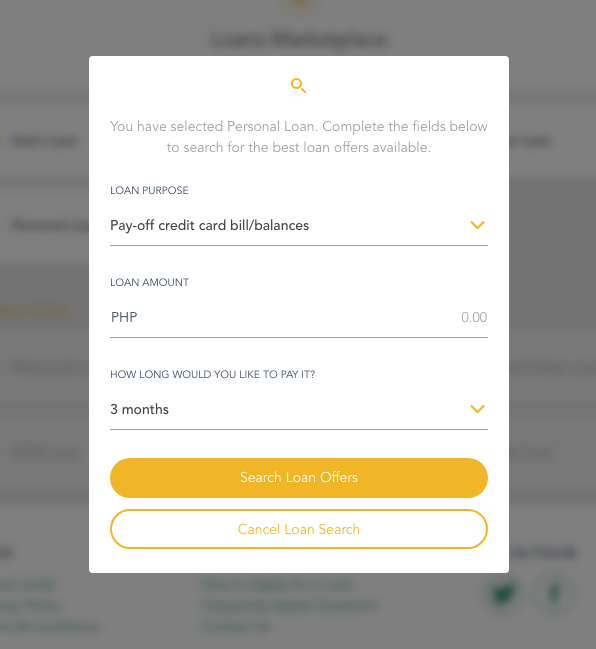

What is Lendr?

What is Lendr?

HI,PAG NA APPROVED YUNG LOAN,PWEDE RIN BA SA CEBUANA MAKUHA ASIDE FROM BANKS

Hello ALbert. Yes, you can get your money sa Cebuana. Please take note of the reference number so you can claim the money.

i apply salary loan thru lendr and they offer me to MCC… but untill now my application is still on process.. its almost 2weeks but no one call me

Hi Catherine. It could be due to voluminous loan applications given the Christmas season. You can contact Lendr by sending them an email at [email protected] Thanks!

Hi, good day, ask where did get the Reference code if new applicant?

Hi Maria! The reference code will be sent by Tala kapag magbabayad na po kayo ng loan 🙂

hi how long it takes to approve ba yung salary loan ?

Hello Melchor! This depends per bank po since it is up to them na. Just make sure you submit all requirements para po mas mapabilis ang pag-proseso ng iyong loan application. Salamat!

hi po. what if may delinquent cc ka. may chance kaya na maapprove ka since bank parin talaga ang magpapaloan?

Hi Kay! The delinquent credit card will be considered when the lender reviews your loan application. We suggest that you pay off your credit card first before making any loan application since this will affect your approval rate. Thanks.

Nag sing up ako at nag apply last week pa bakit hanggang ngayon wala pa ko rin notice kung na approve or disapprove?

Hi Derick! Online cash lenders would want to process every loan application as quickly as possible, but there are limitations as well. Please be patient. Surely, Lendr is on top of your application 🙂