Recent Posts

Tag Cloud

Akulaku

Availa

Bank Loan

BillEase

Binixo

Business Loans

Cashalo

Cash Mart

Cashwagon

Comparison

Credit24

Doctor Cash

Dr Cash

Esquire

First Circle

First Circle Review

Home Credit

Home Credit Philippines Review

How to apply

Installment plan

Lazada

Lazada Installment Plan

Lendr

Loanranger

Loan Ranger

Moola

My Cash

Online Cash

Online Cash Loan

Online Loan

Online Personal Loan

PAG-IBIG

PAG-IBIG Multi-Purpose Loan

Pera247

Personal Loan

Quickpera

Review

Robocash

SALAD

Security Bank

SSS Loan

SSS Salary Loan

Tala

Tala Loan

Tala Philippines

Recent Comments

- loans on Home Credit Review: What Customers Have to Say About It

- loans on Get an Installment Plan for Your Lazada Purchase with the Help of BillEase

- loans on Home Credit Review: What Customers Have to Say About It

- Nick on Home Credit Review: What Customers Have to Say About It

- Michaela on Home Credit Review: What Customers Have to Say About It

Archives

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- February 2020

- October 2019

- September 2019

- June 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- February 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- February 2017

Categories

- Aeon Philippines

- Akulaku

- Atome (Kredit Pintar)

- BillEase

- Business Loans

- Cash Mart

- Cashalo

- Cashwagon

- Credit24

- DiskarTech

- Esquire Financing

- First Circle

- Home Credit

- Jungle

- Lazada Loans

- Lendr

- Loan Ranger

- Moola Lending

- Online Cash Loans

- Pag Ibig

- Paylater

- Pera247

- PeraJet

- Personal Loan

- PondoPeso

- Robocash

- Security Bank

- Shop Now, Pay Later

- SSS Loan

- Tala Philippines

- TendoPay

- UnaPay

- Uncategorized

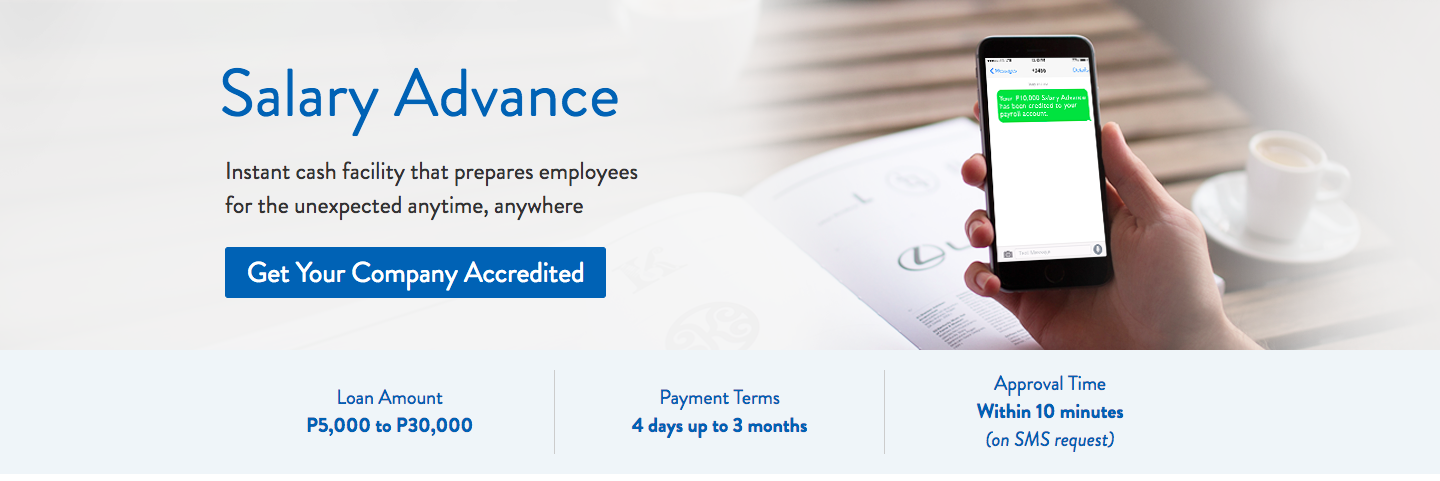

What is Security Bank’s Salary Advance Loan?

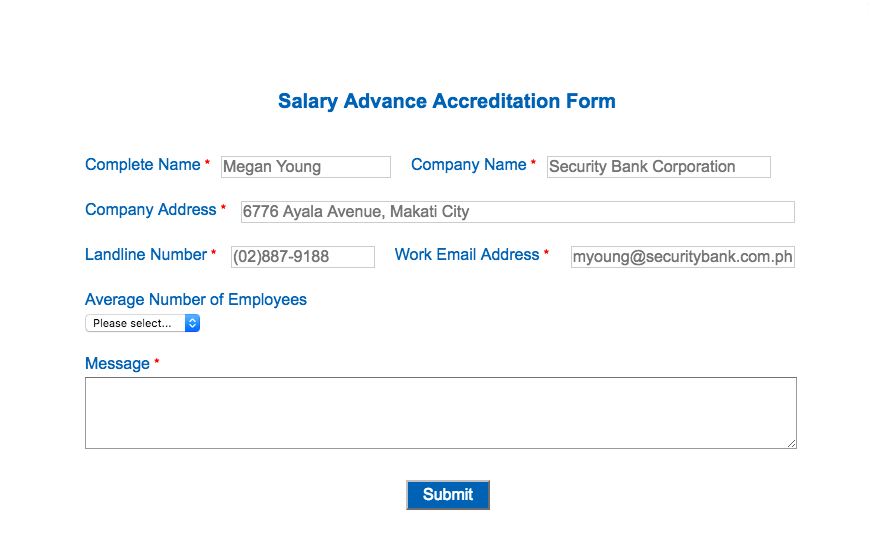

What is Security Bank’s Salary Advance Loan?  For companies who wish to be accredited by Security Bank, you can submit the Salary Advance Accreditation Form and other documents for accreditation such as Memorandum of Agreement (MOA) and Secretary’s Certification or Board Resolution showing the authorized signatories of the company.

For companies who wish to be accredited by Security Bank, you can submit the Salary Advance Accreditation Form and other documents for accreditation such as Memorandum of Agreement (MOA) and Secretary’s Certification or Board Resolution showing the authorized signatories of the company.

how can i apply personal loan

Hello Danilo. The company you are working for must be accredited by Security Bank in order to qualify for the Salary Advance Facility. If not, you can initiate accreditation of your company through this link – https://www.securitybank.com/personal/loans/corporate-employee-loan/salary-advance/accreditation-form/

Hey there.

I already have a Salary Advance account, and I just paid it off completely. How do I renew?

Hi Vlad, you renew through SMS just like your initial loan.

how can i renew? what to type and what number

Hello Louie! Here’s how to re-avail: SBC SALAD AMOUNT # OF DEDUCTIONS to 3456 and follow the succeeding SMS instructions.

Hi ,

Sir /Ma’am ask ko lang po how i will avail salary advance , kasi po di pako maka avail through text ano po ibang way ?

Hi! Is your company accredited by Security Bank? If yes, have you signed an enrollment form? These are the things you need to check and do before you can apply for SALAD 🙂

how many days will it take before I can renew after the last deduction for the initial loan?

Hello Casey! As long as you are fully paid already, you can apply again. Simply text SBC SALAD AMOUNT # OF DEDUCTIONS to 3456 and follow the succeeding SMS instructions 🙂 Hope this helps!

Hi, I received a notification that I am already eligible to reavail the salary advance but after sending message to 3457 I never received a reply to confirm/agree with the loan. Will it take some time to receive that message?

3456 rather

Hello Faye! Did you apply again? If yes, did you follow the format (SBC SALAD AMOUNT # OF DEDUCTIONS) ? It usually takes 10 minutes or longer to find out if you qualified for the Salary Advance Facility. Hope this helps! 🙂

Hi! I do received the notification of salary advance info credit limit. I’m trying to apply for it but 3456 won’t send reply. What do I need to do?

Hello Owen. Did you follow the format in applying for the Salary Advance Facility? Also, is your company accredited by Security Bank? This could be the reason why there is no reply.

I just finish my load today since on the mesg the last day will be 24th will I received an sms for that?

when ca I renue for a new one

Hi Marcial. You can apply again as long as you are cleared with your last loan 🙂

I already paid up my last load 3 weeks ago, as of this moment havent received a text that I am eligible to re avail the salad? When I try to text the format getting a message that my number is currently not enrolled. How come been doing this once in a while.

FYI, recently got approved with SB Credit Card. Is that the reason why I cant reavail the salad?

Hi JB16! Regarding this, you may call the SBC Customer Service Hotline at (632) 88-791-88 or email [email protected] Salamat!

Is the interest being deducted right away or you get the full amount of your loan?

Hi Tyrone! Only the processing fee will be deducted from the proceeds of the loan. The interest will be charged on the payment day, or your next salary day.

Just paid off my Salary Advance, how many days do I need to wait to renew?

Hello there. Please confirm clearance before you can apply again. Some lenders take time to update their system to make sure that payment was already made. Thanks!

Hi how about if iam resign already ? Can i apply a loan? I will personaly pay it at branch is that possible?

Hello Shindi. Apparently, the Salary Advance Facility will only work for employees whose company is accredited by Security Bank. You can no longer use this po due to non-employment (but we do hope you can find a new one soon!) 🙂

Hi Injust paid off my salad loan yesterday but I cant renew now said my acct is ineligible.

Hello there. It’s possible that the payment made was not yet reflected in their system. To be sure, you can send them a copy or proof of payment so they could take note of it 🙂

Hi! I also paid off my salary advance loan. I sent a text message to renew but it said there that I am still not approved to my account’s ineligibility. What can I do to renew? Thank you for the response.

It said there that I am still not approved due to my account’s ineligibility*

Hello Ann! This could mean that the payment has not yet reflected in their system. You can try emailing them and provide a proof of payment so they could manually adjust your records, thereby allowing you to borrow again 🙂

Yeah.. same thing happened to me. Tried to renew but says account ineligibility.

Hi Dan! Perhaps, the payment was not yet reflected in their system. You can call Security Bank Customer Service at 887-9188 or email them at [email protected] for further assistance. Thanks!

How much ia the interest?

Hi Yujin! Per Security Bank website, the interest rate depends on the prevailing market rate at the time of application 🙂

i lost my simcard where security bank send sms for salary advance availment. How will i change the phone numberand how many days should i wait to avail the salary advance? Thanks in advance.

Im on my renewal for salad. But i lost my simcard. Do i need to apply again and fill out a form? How long should i wait?

Hi LA! You can call the SBC Customer Service Hotline at (632) 88-791-88 or email [email protected] to update customer information. Thanks!

I should recieve a message now that i can avail for sallary loan.. But i havent recieved one yet? We badly need the money for emergency. . . what happened? You guys should recieved the payment last thursday. . .

Hi Jouses. To be clear po, you had a previous Salary Advance and want to avail another SALAD? Perhaps the payment has not yet reflected in Security Bank’s system that’s why the bank cannot process your loan application. It may take some time, but surely, Security Bank wants to assist you on this.

I never received any reply from 3456 for more than 24 hours

Do they have a calculator for the monthly amortization for salary advance? And how much is the interest rate since it’s a short-term loan?

Hi Axis! Apologies, but Security Bank has no loan calculator available for this facility on their website. We are also not sure as to the interest rate since it was not disclosed as well. Nonetheless, you can ready more about this facility here – https://www.securitybank.com/personal/loans/corporate-employee-loan/salary-advance/

Hello,i received a text from security bank regarding salad renewal, it says its valid until jan 31st but i didnt renew it.now i need fund for my daughters tuition,how can i re avail of SALAD?

Hi Kavin! You can apply by sending SBC SALAD Amount of Loan Number of Deductions to 3456 🙂

Hi! I’ve applied for Salary advance just yesterday. I’ve seen here that the approval usually only takes atleast 10 mins. it’s been over a day and I haven’t receive any confirmation yet.

Hi Tina! That is Security Bank’s promise and surely, they want to live up to that. Perhaps they are processing tons of applications; hence the delay. Don’t worry. They’ll get back to you as soon as they can 🙂

how will i know if how much is the salad that i can borrow?

Hello Tashkie! Only Security Bank can tell since they are the one assigning the credit limit per borrower. Nonetheless, minimum amount is P5,000 🙂

Hi! I have a new no. And I already update it to the bank. I think almost a month already. How can I Avail the SALAD loan because when I regestered it thru sms I got a response that my no. Is not enrolled?

Hi Michael! Please call the SBC Customer Service Hotline at (632) 88-791-88 or email [email protected] for change of mobile number. Salamat!

Hi,

I am trying to renew my loan via text since i got a notification via SMS. im getting an error as your Salary Advance facility is down. How long does it take and when can i re-avail for the said loan and get the facility up and running.

Hi Roger! Per Security Bank website, please wait for three days from the time of last payment before you can re-loan 🙂

Hi, i still have 2 payments left is it possibkento offset the remaining balance for a renewal we badly need the money for emergency. Thanks!

Hi Jana. You cannot avail SALAD unless your existing salary advance is fully paid po.

How can we check the status of our salary loan??

Hi Yhell! Please wait for Security Bank since they will send you a text message regarding the status of your salary loan application. 🙂

is theres an option to offset my remaining balance, i just need it for emergency purpose. i still have 1 deduction left. is it posible to do arrangement like this?

Hi Ann! Please contact Security Bank directly regarding this at SBC Customer Service Hotline at (632) 88-791-88 or email [email protected] Thanks!

Hi I just changed my number and updated it to the bank last April6, Just finished my Salad as well last payday, when can i apply for the next?

thanks

Hi Bella! You may apply for a re-loan at least three days after the last payment. Thanks!

Hi. I am jayrose gamido I already completed 6 months on my current job. I’m a regular employee now. The company that I am working is afiliated to security bank and upon filling up the form for security bank I made sure I input my number correctly . But why is it that I didn’t received a notification that I am already eligible for the SALAD of Security bank?

Hi Jayrose! Security Bank has minimum requirements to comply with:

– active employee with regular/permanent status of employment

– with active payroll account of at least six (6) months payroll credits

– with at least 5,000.00 average Salary Net Credits

– with no adverse findings

Please ensure po that you are able to meet these requirements so you can qualify for SALAD 🙂 Thanks!

Hi I would like to ask if I am eligible for this SALAD since my Company is accredited with the bank. Now I am goong to turn 19 years old and I am already 6 months being with the company. Can I do SALAD now?

Hi! It turns out that there is an age requirement for this. You must be at least 21 years old to become eligible for SALAD.

Hi,

I’d like to know, how long does it usually take for the payment to be posted on the system? Also when considering to renew but haven’t received any text messages yet confirming of the illegibility, can the borrower use the previous messages that was sent for renewal? (previous amount offered)

Hi Lyn! Per bank’s website, please give them at least three days to process and confirm payment 🙂 After that, you can apply for another loan. For more details, please call the SBC Customer Service Hotline at (632) 88-791-88 or email [email protected] Thanks!

Hi! I just wanted to ask about the salary loan thing. In my previous company I have an outstanding unpaid Salary Loan when I resigned. I have my new employer now and Security bank is the service provider for our payroll will Security Bank deduct the money I owed from my previous company to this new one? I hope you could answer my question.

Hi John! We think it doesn’t work that way since there are two employers involved. What could be done is that your previous company will just deduct the unpaid loan to your separation pay.

My salary advance from my previous company still unpaid and now my new employer also have security bank as their payroll. Is there any conflict between the 2 payroll account or do i have to merge it?

Hi Samantha. You may update your employment records by sending an email tp Security Bank ([email protected] ) or calling them thru their hotline (887-9188). Thanks!

Hi. Why I can’t send message sin 3456? Tama naman tinype ko SBC SALAD AMOUNT NO. OF DEDUCTION (SBC SALAD 15000 6)

Hi Mark! Did you apply your mobile number to be eligible for SALAD?

Hi! It’s my first time to apply I always missed the SALAD schedule in our company can I just go directly in a securitybank near in my area to apply?

Hi there! If that’s the case, it won’t be SALAD anymore since this is integrated to the company’s payroll system. You may coordinate with your HR regarding this. Thanks!

hello there anytime i will apply for the said advance loan,it will reply and say this mobile number is currently not enrolled to avail…my question is how can i avail the said loan and enroll my mobile no.

Hi Edmundo! Please submit an application form to Security Bank to enroll for this facility.

I already updated my mob # for sal ad a month ago but theres no response yet until now.

Hi Mark! Please check with your HR department as well since sila po ang nakikipagcoordinate din with Security Bank. Thanks!

Hi! I just want to ask. I already apply for SALAD. Would that be fine if Ill gonna pay it thru the counter and will not wait for may Payday? And also I recieved a confirmation today and it says ” the amount due will be put on hold 2 days before the payday” . What does it mean?

Hi Arci. You can pay over-the-counter at Security Bank branches. Take note of the steps:

– Use the BILLS PAYMENT slip

– Indicate payment is for SALAD

– Indicate your monthly amortization plus penalty

– Indicate your enrolled mobile number

The amount due is already on hold, which means nakabawas na po yung amount na swelduhin ninyo on your next payday.

How long does it normally take to get approved by Security Bank?

Hi Roy! Per Security Bank website, it will only take minutes and you will be informed of the status of your loan immediately. Of course, there will be delays, but rest assured that Security Bank is reviewing your application.

Kapag ba payroll namin e ang Security Bank automatic kasama n company namin sa Salary Advance Accreditation?

Hi Sei! You can confirm this with your HR Department just to be sure 🙂

Hi

I just want to ask, is there a designated time that I can avail SALAD?

I got an approval SMS already but upon replying SBC SALAD AGREE, system replied that Security Bank’s salary advance is temporarily not available for crediting and just try for a few minutes.

What is the best time for me to reply again? Do I need to text the amount again or just the SBC SALAD AGREE only?

Thank you!

Hi Joy! We’re not sure regarding the time. Please contact the Customer Hotline of Security Bank so they could check your loan application and para hindi rin ma-doble. Thanks!

Hi, where should I submit the requirements? Will it be via email or direct to one of the security bank branches? Thanks.

Hi Pau. Submit it in any Security Bank branches.

Nka rigester n ko pero ang reply skin.. Hindi pa daw enrolled ung no. Ko

Please fill out the enrolment form to have your number accredited – https://www.securitybank.com/personal/loans/corporate-employee-loan/accreditation-form/?websource=d-forms

My mobile number is not currently enrolled to avail this. What shall I do?

Hi Nicole. You must fill out an online application form (https://www.securitybank.com/personal/loans/corporate-employee-loan/accreditation-form/?websource=d-forms). Make sure that your employer is accredited by Security Bank to avail this facility.

Hi, I already resigned from my previous company. But I have balance for my SALAD. What will happen if I can’t pay the remaining balance aside from the penalties I get? Will I get banned from the SB?

SALAD is a bank loan like any other, so even if you already resigned, you still have an obligation to repay the loan.

If you let it fall delinquent it will affect your credit standing with SB and any other bank as all loans are reported to CIC.

So best to reach out to SB and find an agreement on a settlement plan if you are short on cash right now.

Hi, im trying to use SALAD. To get advance salary. But my mobile # is not enrolled.

Hi JC! You have to enroll your mobile number first before you can apply for SALAD. You can go to the nearest Security Bank branches and request for an application form on SALAD so you can apply. Thanks!

I missed to pay this cutoff can i pay may balance to next cutoff?

Hi Jefferson. In case you aren’t able to pay, here’s the procedure per Security Bank website:

You can make an over the counter (OTC) payment in any Security Bank Branch nearest you. Kindly make sure to do the following:

– Use the BILLS PAYMENT slip

– Indicate payment is for SALAD

– Indicate your monthly amortization plus penalty

– Indicate your enrolled mobile number

NAKARECEIVED NA AKO NG CONFIRMATION SA SECURITY BANK NA UPDATED NA YUNG PHONE NUMBER KO PERO BAKIT WLA PARIN AKONG OFFER FOR SALAD?

Hi Rowen. You will be the one applying for SALAD. Send a text message and send it to 3456 in this format:

SBC SALAD Amount of Loan Number of Deductions

Hello, I just finished mine yesterday and also I do have the Security Bank app and it shows there that it was already paid/posted, however upon trying again the number won’t reply and I’m the under of impression that maybe because its weekend, is SALAD available during weekends? 🙂

Hi Nico. Security Bank did not say that SALAD is only available during weekdays only. Nonetheless, you could send an email [email protected] for further assistance and so that they could check the status of your application.

tanong lang ako. kasi may confirmation na approved yung salary advance ko kaso kinabukasan pa ko nakareply ng saturday ng ARGEE tapos wala na dumting na reply sa security bank. Di na ba ko pwedeng mag text ulit at mag request?

Hi Castiel. Please call Security Bank hotline at 88-79188 so they could check on your request. Baka po kasi ma-doble. Thanks!

Hi ask ko lang,pwede pa kaya ako mag apply ng ibang SB products kahit may SALAD pa ko? I have 5 remaining payments pa sa SALAD and 2nd loan ko na yun..I wonder if pwede magreloan kahit may existing pa..though yung second offer sakin ay malaki na unlike the first one..

Hello Aian! That would depend na po on the bank. If you can show sufficient proof that you can pay your loan, then there is a possibility of approval.

Hi Security Bank,

Good day!

This is regarding about the SALARY ADVANCE that you are offering.

I tried it before and I was able to avail it. But right now, upon trying to avail it again, I was just receiving a response from 3456 that says ”Your request is currently being processed. Thank you for choosing Salary Advance.”

Then there will be no follow up response after that. I am currently an employee of RMS COLLECT PHILS. INC — an IQOR Company.

Hoping for your response. God bless us!

Thanks you,

Jericho Joshua B. Bautista

Hi Jericho! Is your company using Security Bank for salary disbursement? If yes, then you may contact the bank so they could manually look into you loan. Otherwise, you cannot borrow if the bank used is not Security Bank.

hi how many days for me to know if my application is approved?

Hi Leonel. Usually, it would take minutes per the bank’s website 🙂

Hi,

Can I pay my remaining balance in advance? If so, when can I re-apply for a Salary Advance? Thanks in advance.

Hi Lyn! Yes, Security Bank allows early repayment. Please wait for 48 hours before you can re-apply for SALAD to ensure that the payment will reflect on their system. Thanks!