Recent Posts

Tag Cloud

Akulaku

Availa

Bank Loan

BillEase

Binixo

Business Loans

Cashalo

Cash Mart

Cashwagon

Comparison

Credit24

Doctor Cash

Dr Cash

Esquire

First Circle

First Circle Review

Home Credit

Home Credit Philippines Review

How to apply

Installment plan

Lazada

Lazada Installment Plan

Lendr

Loanranger

Loan Ranger

Moola

My Cash

Online Cash

Online Cash Loan

Online Loan

Online Personal Loan

PAG-IBIG

PAG-IBIG Multi-Purpose Loan

Pera247

Personal Loan

Quickpera

Review

Robocash

SALAD

Security Bank

SSS Loan

SSS Salary Loan

Tala

Tala Loan

Tala Philippines

Recent Comments

- loans on Home Credit Review: What Customers Have to Say About It

- loans on Get an Installment Plan for Your Lazada Purchase with the Help of BillEase

- loans on Home Credit Review: What Customers Have to Say About It

- Nick on Home Credit Review: What Customers Have to Say About It

- Michaela on Home Credit Review: What Customers Have to Say About It

Archives

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- February 2020

- October 2019

- September 2019

- June 2019

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- February 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- February 2017

Categories

- Aeon Philippines

- Akulaku

- Atome (Kredit Pintar)

- BillEase

- Business Loans

- Cash Mart

- Cashalo

- Cashwagon

- Credit24

- DiskarTech

- Esquire Financing

- First Circle

- Home Credit

- Jungle

- Lazada Loans

- Lendr

- Loan Ranger

- Moola Lending

- Online Cash Loans

- Pag Ibig

- Paylater

- Pera247

- PeraJet

- Personal Loan

- PondoPeso

- Robocash

- Security Bank

- Shop Now, Pay Later

- SSS Loan

- Tala Philippines

- TendoPay

- UnaPay

- Uncategorized

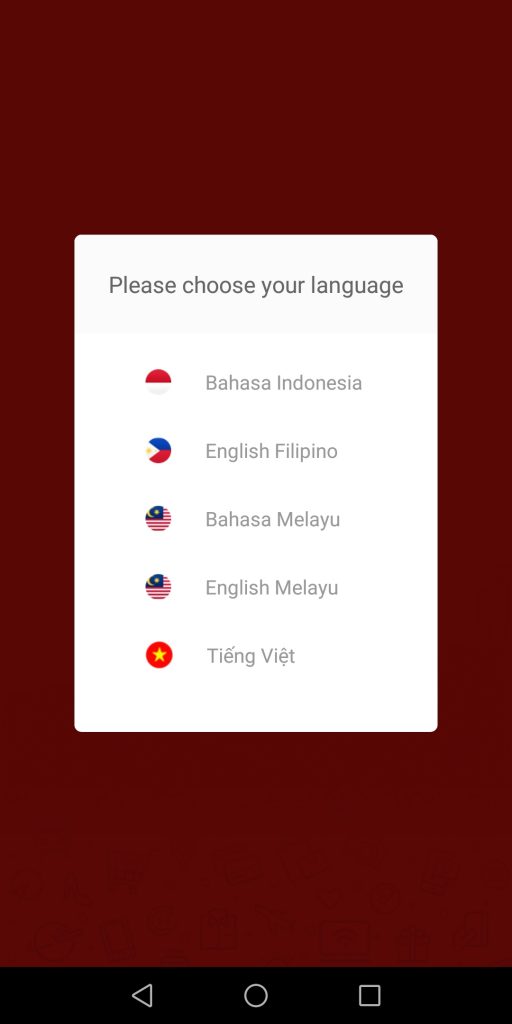

Step 2: Once installed in your mobile phone, choose your preferred language.

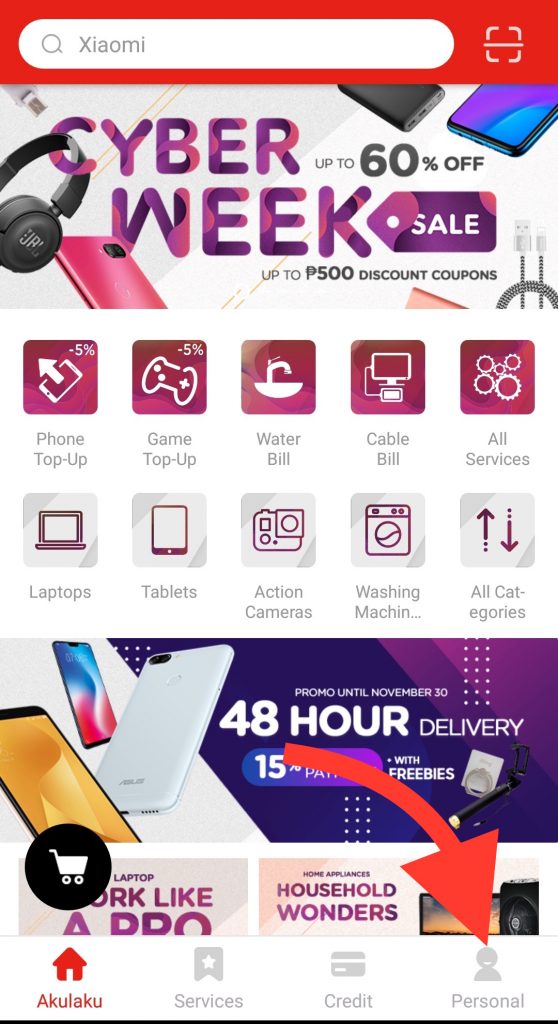

Step 2: Once installed in your mobile phone, choose your preferred language.  Step 3: On the landing page, click Personal. The Personal tab will also reflect your personal infomation as well as the status of your orders.

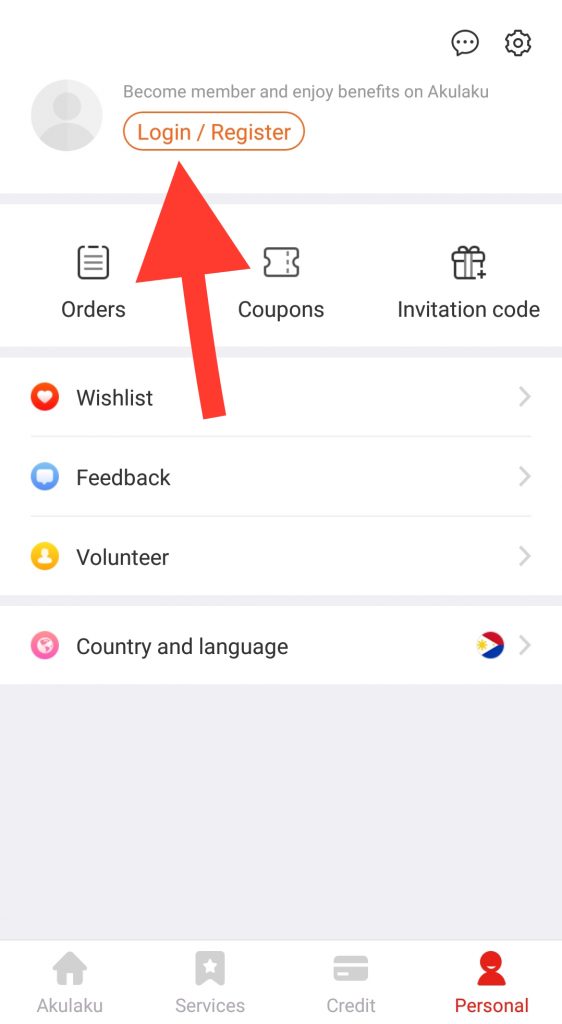

Step 3: On the landing page, click Personal. The Personal tab will also reflect your personal infomation as well as the status of your orders.  Step 4: Click Login / Register

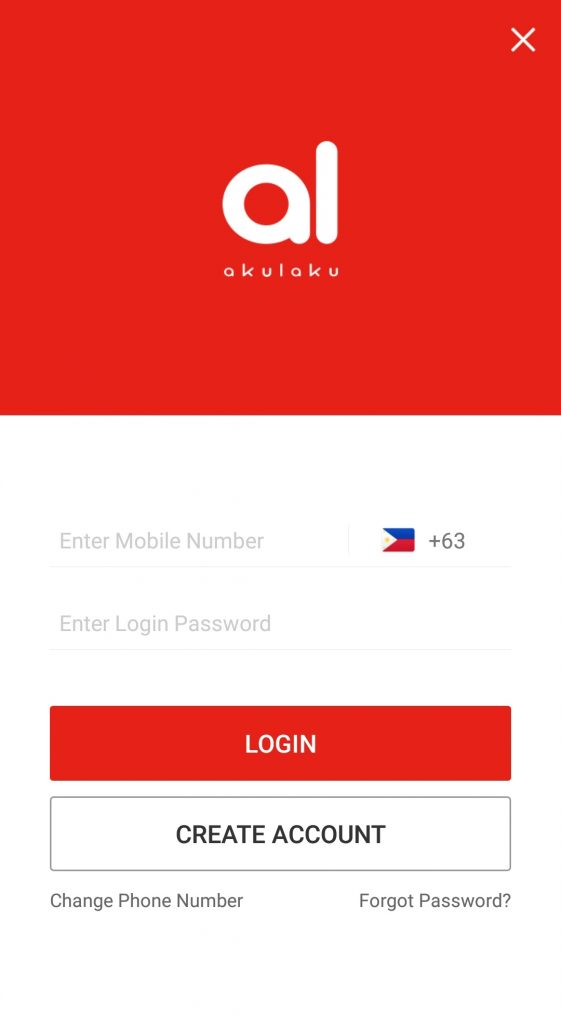

Step 4: Click Login / Register  Step 5: Enter your mobile number and preferred log-in password. Then, click Create Account.

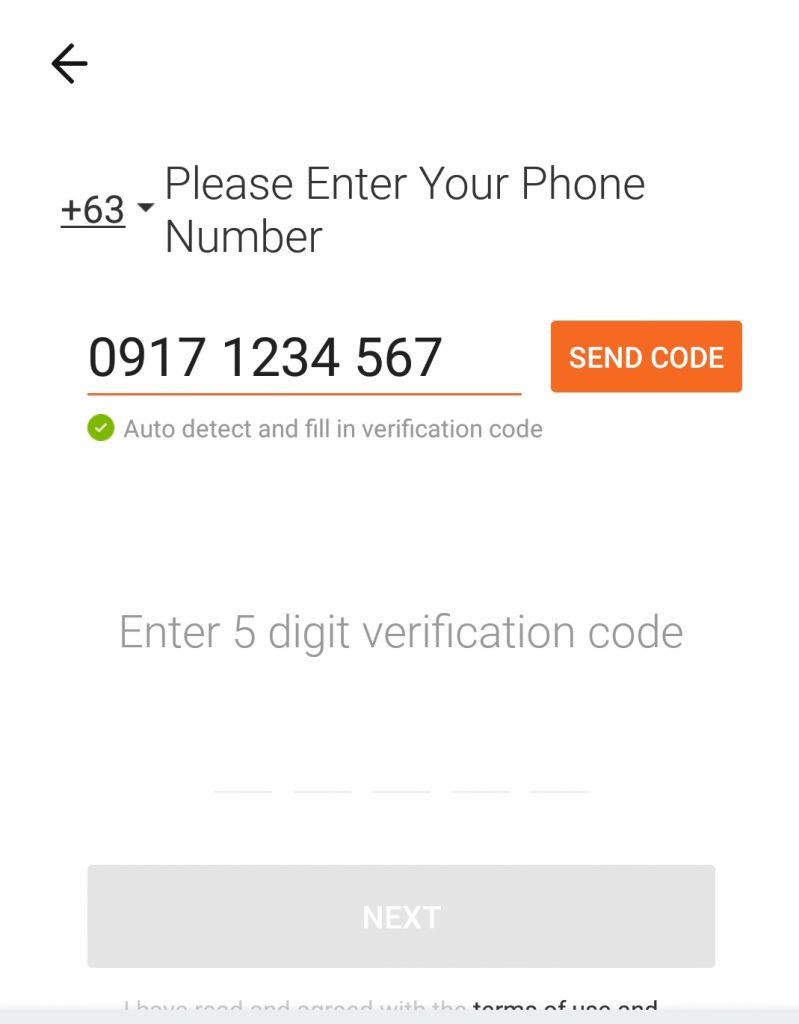

Step 5: Enter your mobile number and preferred log-in password. Then, click Create Account.  Step 6: Enter your mobile number again and then click Send Code. A Verification Code will be sent to the mobile number you registered. Copy and then enter the code to proceed with your registration.

Step 6: Enter your mobile number again and then click Send Code. A Verification Code will be sent to the mobile number you registered. Copy and then enter the code to proceed with your registration.  Step 7: You will be back in the landing page as soon as you successfully verified your account. Click Credit.

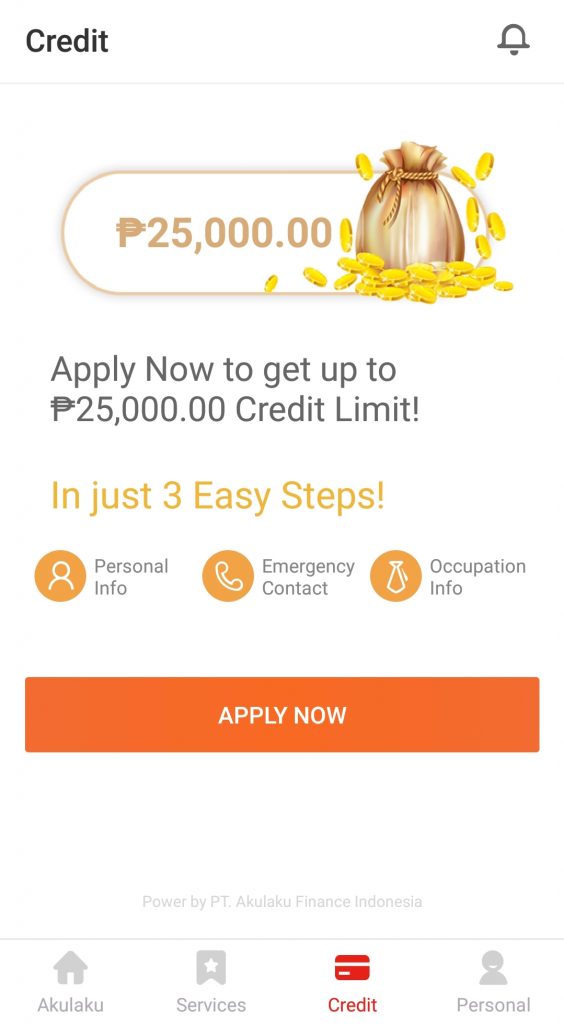

Step 7: You will be back in the landing page as soon as you successfully verified your account. Click Credit.  Step 8: On the Credit landing page, click Apply Now.

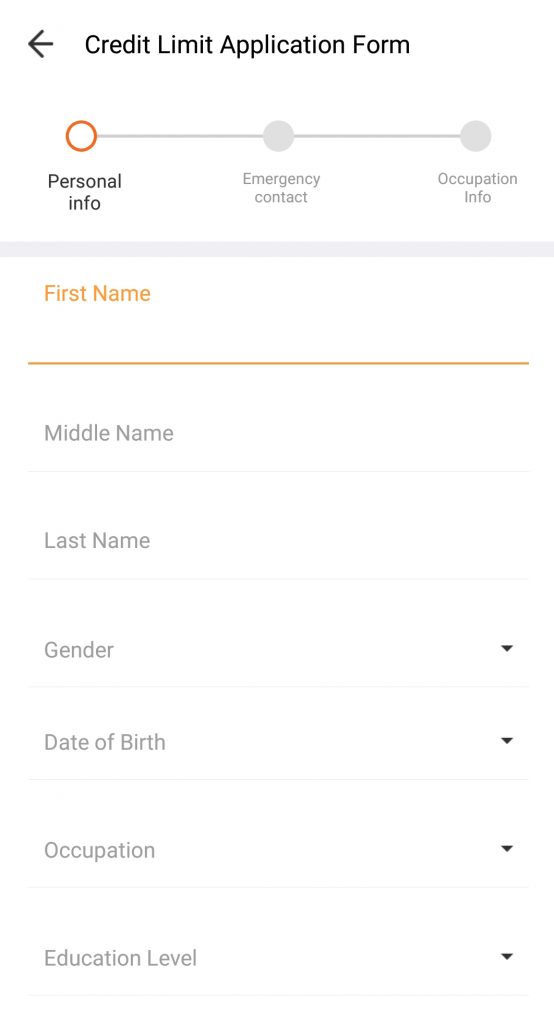

Step 8: On the Credit landing page, click Apply Now.  Step 9: Fill out the Credit Limit Application Form truthfully. Make sure that the details reflect who you are.

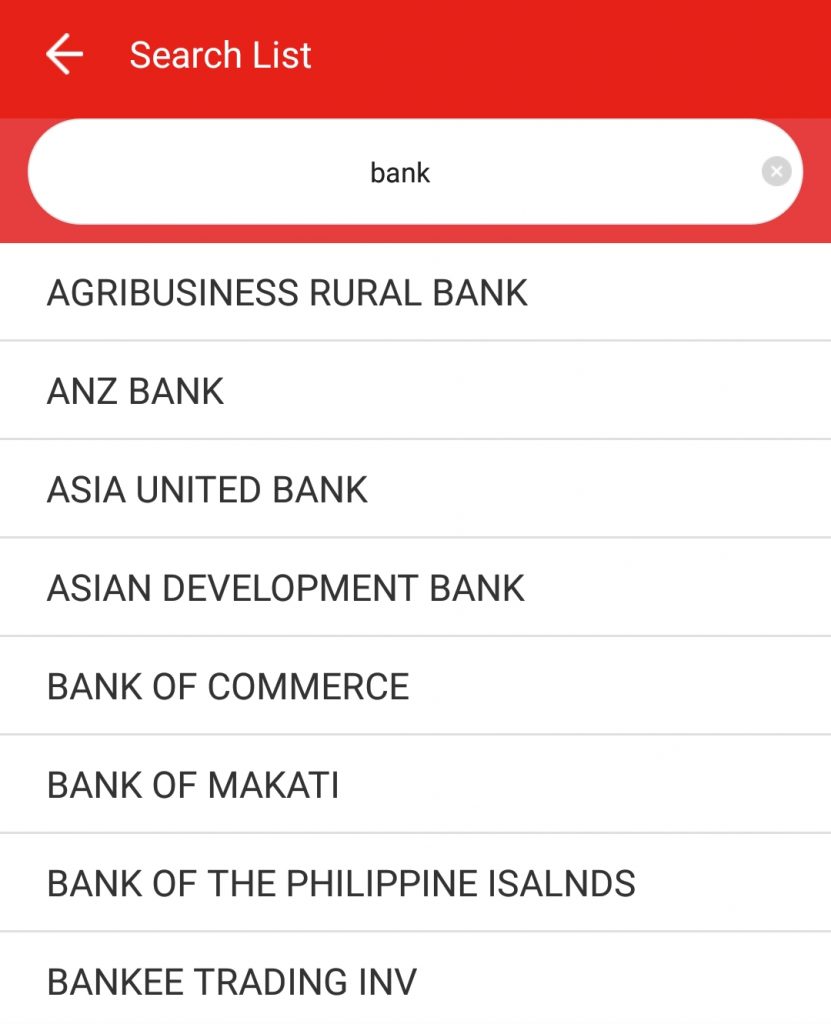

Step 9: Fill out the Credit Limit Application Form truthfully. Make sure that the details reflect who you are.  Step 10: Search for your corresponding employer. In case your employer is not on the list, simply input your employer’s name.

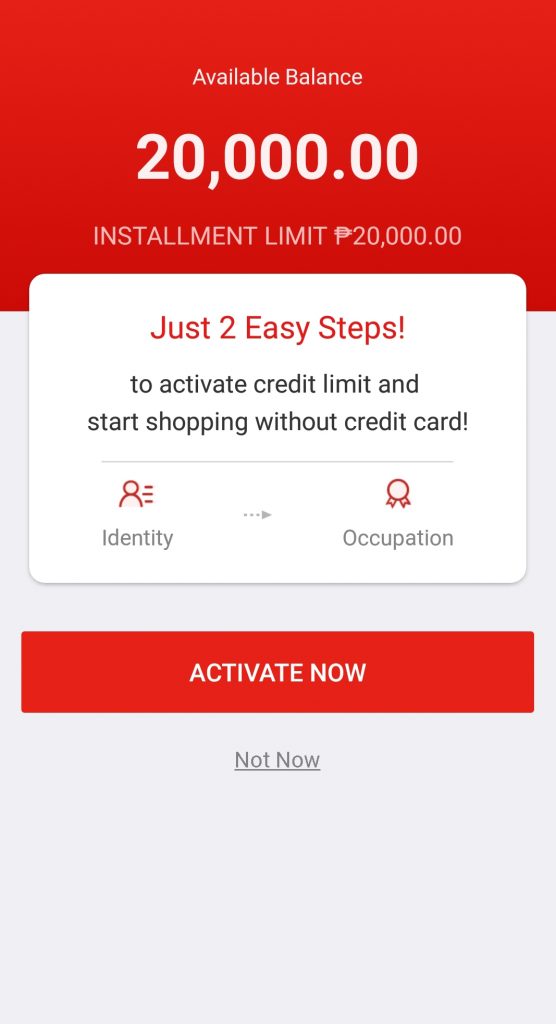

Step 10: Search for your corresponding employer. In case your employer is not on the list, simply input your employer’s name.  Step 11: You will be asked to activate your account so you can avail of Akulaku services. Click Activate.

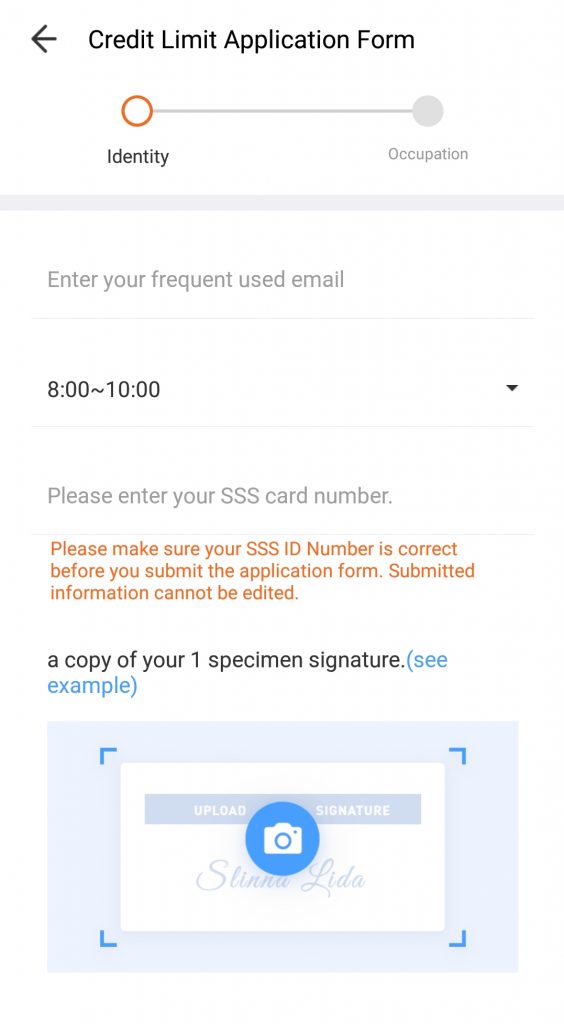

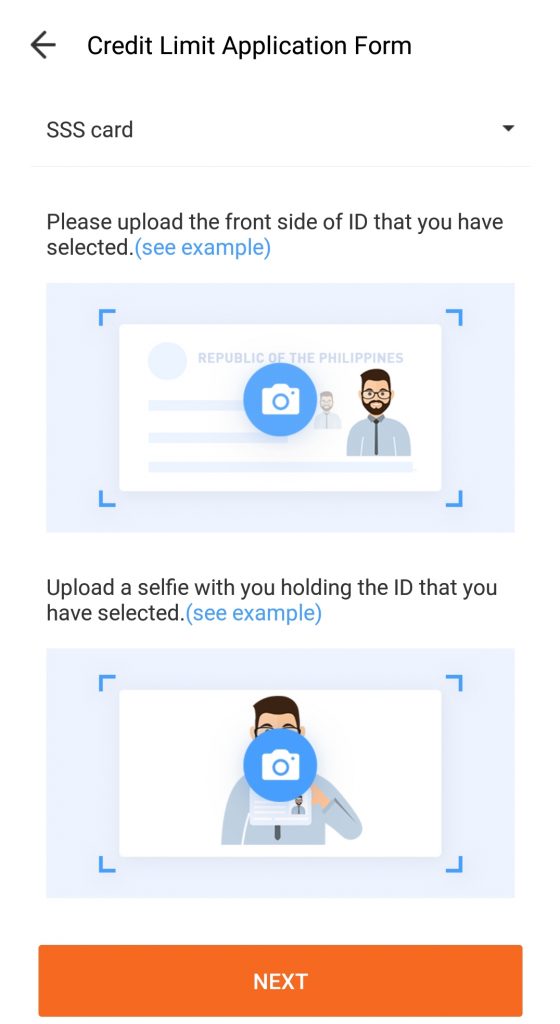

Step 11: You will be asked to activate your account so you can avail of Akulaku services. Click Activate.  Step 12: Input the necessary information being asked, including the convenient time you want to be contacted. Make sure to upload clear picture of your ID to make it easy for the Verification Team to process your application.

Step 12: Input the necessary information being asked, including the convenient time you want to be contacted. Make sure to upload clear picture of your ID to make it easy for the Verification Team to process your application.

Step 13: As soon as you completed Step 12, your account will now be reviewed by Akulaku team. Per Akulaku website, your credit limit application will be reviewed and processed within 48 hours. A representative from Akulaku’s Verification Team will also call you on within that 48 hours to check the information you provided.

Step 13: As soon as you completed Step 12, your account will now be reviewed by Akulaku team. Per Akulaku website, your credit limit application will be reviewed and processed within 48 hours. A representative from Akulaku’s Verification Team will also call you on within that 48 hours to check the information you provided.

Can I aplly for a loan my main source of income is only space for rebt but I have remmitances from the USA

Hello Amado. Yes you can. You just have to upload a photocopy of bank statements or any proof showing that you have this amount every month.