Grocery Now, Pay Later With Jungle

We’re already seven months (and counting) into this pandemic. How are you doing so far?

The Covid-19 pandemic took a toll in many of us, especially when it comes to financial aspect. Thousands lost their jobs and many are struggling on how to get by everyday. Unfortunately, bills won’t stop coming and expenses such as grocery will keep knocking at your door. After all, we need food, right?

What if we tell you that there is a service that lets you borrow money for groceries and then pay them on installment basis.Believe it or not, this exists and it goes by the name Jungle.

Who is Jungle?

Jungle is a Buy Now, Pay Later app that lets you buy products or avail of a service and then pay on fixed monthly installments. The good thing about this is that credit card or making downpayment are NOT needed to enjoy this service.

At present and as part of their Covid-19 initiative, the company is offering Grocery Now, Pay Later service in the form of Puregold e-vouchers. Aside from this service, Jungle also offers a revolving credit line. This means instead of one-time borrowing, you can borrow multiple times as long as it is within the limits of your credit line.

It is registered under Jungle Lending Inc. with the Securities and Exchange Commission.

For purposes of this post, only the Grocery Now, Pay Later feature will be discussed.

Features of Grocery Now, Pay Later

- Interest rate at 3.5 percent or about P315 for three months. However, this may still be subject to change.

- It is a grocery loan and NOT a cash loan. This means if approved, you can only use the amount to pay for groceries.

- The e-voucher can be used in all Puregold and Puregold Jr. branches nationwide.

- The loan is payable within three months in three equal installments.

How to Apply For Jungle’s Grocery Now, Pay Later

Step 1: Download the app.

The Jungle – Buy Now, Pay Later app is available in App Store (for iPhone users) and Google Play Store (for Android users). This app is also for free.

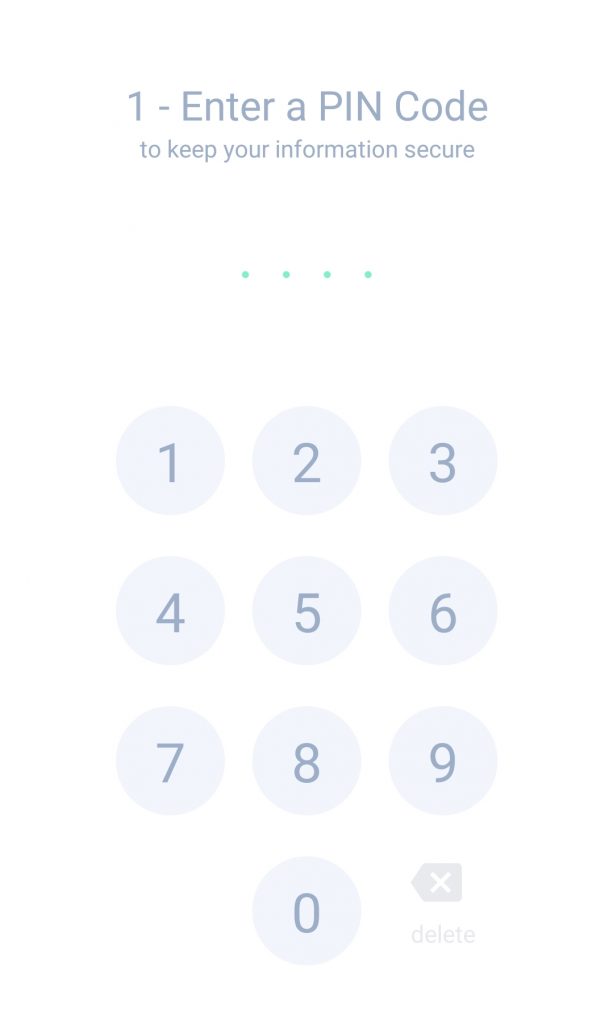

Step 2: Registration

Launch the app after download. Then, you will be asked to register using your Facebook login.

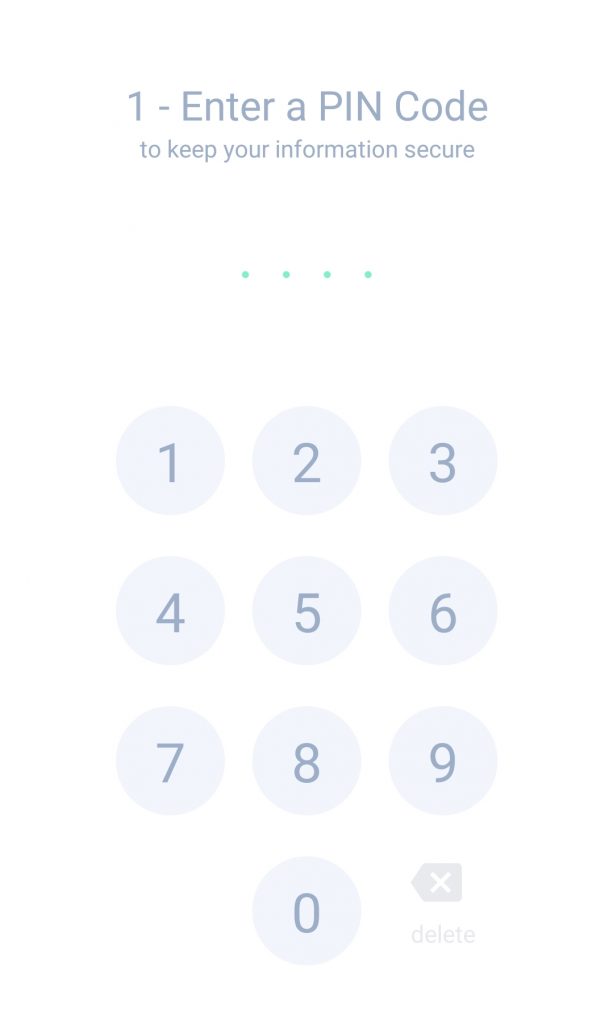

Thereafter, input a four-digit PIN for security.

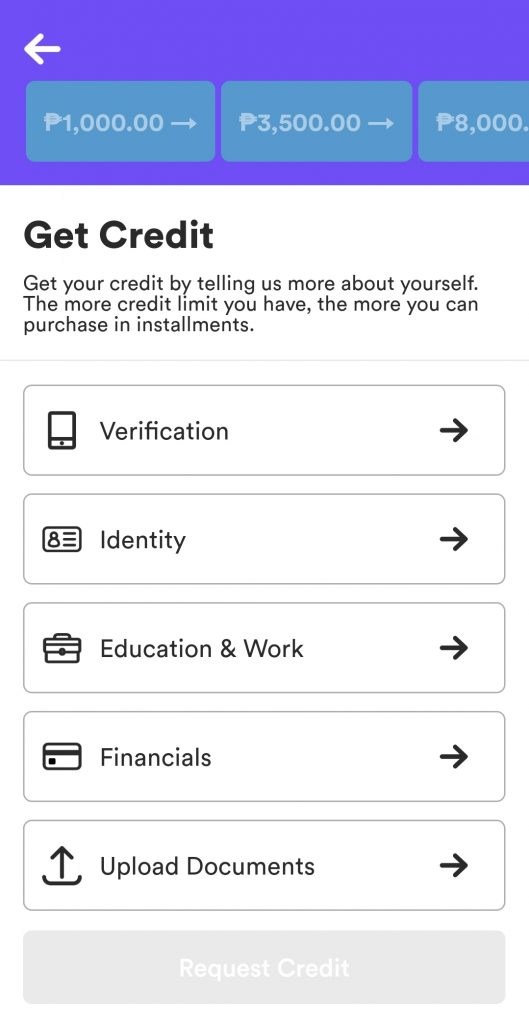

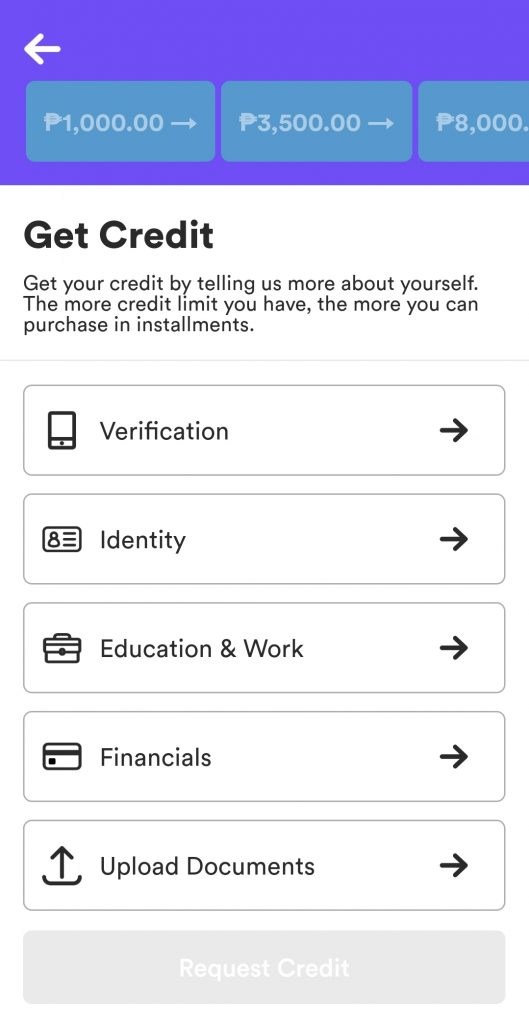

Step 3: Information

To get credit, you will be asked to provide necessary information such as address, current employment including company and job title, and gross monthly income among others.

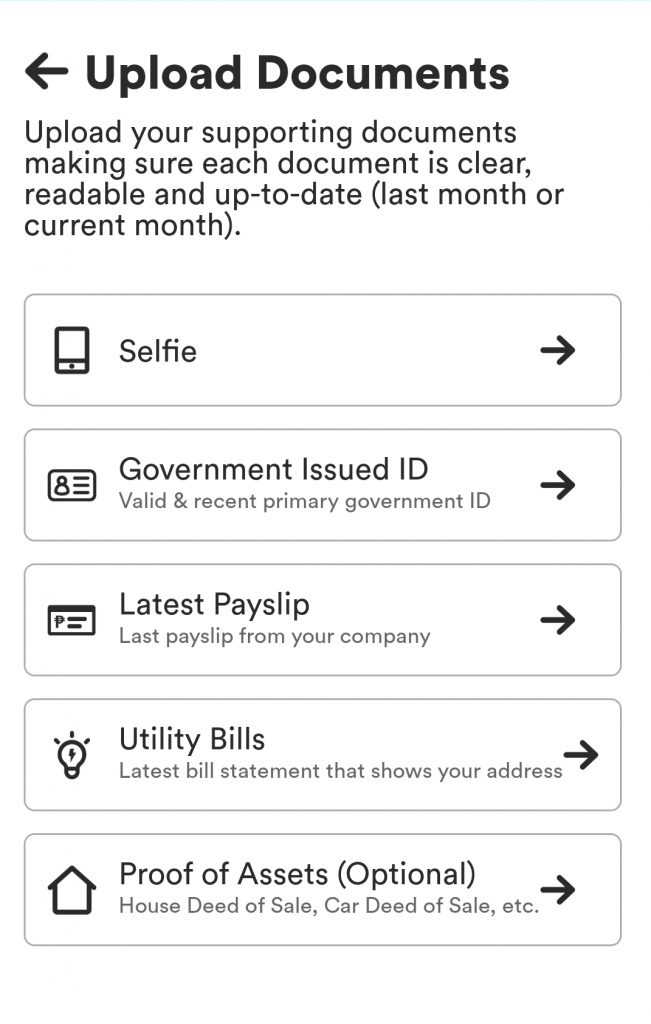

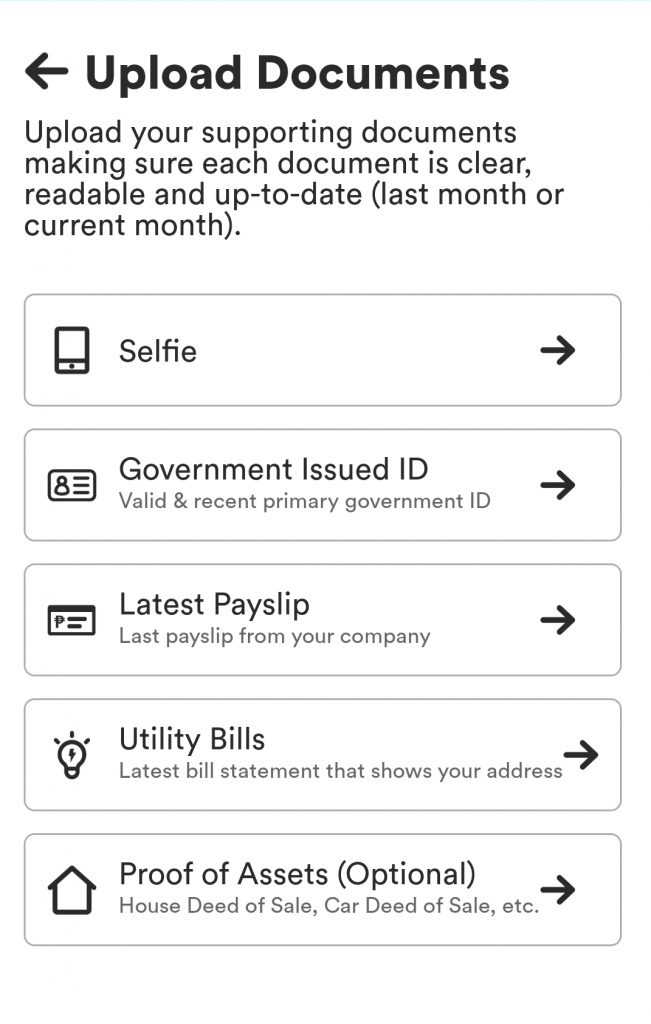

You will also be asked to upload documents including government-issued ID, latest payslip, and a copy of lates utility bill showing your address.

Once you completed the information, you can now request for credit.

Step 4: Loan Processing

Jungle will now evaluate your application. If approved, then you will receive a SMS within 24 hours. You will also be required to check your email address for further instructions, including how to claim your e-voucher.

You can now use the e-voucher in any Puregold branches for your grocery.

Tips To Remember When Applying With Jungle

- Facebook account is a must.

- Make sure you have TIN and SSS numbers. These are needed to make sure that Jungle can effectively conduct background and credit check. Without these two, your loan application will not be processed.

- Make sure you provide complete information. This is also Jungle’s way of verifying your identity as a borrower.

- Upload complete documents to support your loan application. They need to see that you are capable of paying your loan.

- Keep your phone ready. Jungle will call to verify information or ask for supporting documents. If you missed their call, then it could affect your loan application, too.

- Be honest. There’s no point of exaggerating your information since Jungle can check whether the information you provided is truthful or not. Plus, it could adversely affect your loan application, too.

Take note that this service is only temporary. We are not sure until when Jungle will offer Grocery Now, Pay Later and while you’re at it, give it a try.