First Circle: Fast and Simple Business Funding with Just a Few Clicks

It’s not easy to become a business owner. It’s a 24/7 job that requires 100 percent of your time and effort. Plus, you need to ensure that your business is earning sufficient profits and at the same time, you have enough funds left in case you need to fill in inventory, pay necessary expenses, and additional working capital.

Who do you run to if you are short of funds?

Surely, your family or friends could let you borrow money, but don’t rely on them too much. Banks may be your next option, but applying for a business loan from them could be tedious. This is where First Circle comes in.

Read on to learn more about this lender, what it can do for you, and how to apply in case you need additional funds.

Who is First Circle?  Launched publicly in 2016, First Circle is a Philippine-based fin-tech lender that aims to help small-medium business owners with their financing needs. The company understand how difficult it is to apply for a business loan with banks. Plus, not all SMEs have sufficient collateral to cover the amount to be borrowed, which could be a ground for loan rejection.

Launched publicly in 2016, First Circle is a Philippine-based fin-tech lender that aims to help small-medium business owners with their financing needs. The company understand how difficult it is to apply for a business loan with banks. Plus, not all SMEs have sufficient collateral to cover the amount to be borrowed, which could be a ground for loan rejection.

This is why First Circle offers short-term business loans like Purchase Order Financing and Invoice Financing to address financial gap (such as additional working capital and finance operating expenses) in the most convenient way possible. First Circle understands that there are factors beyond your control like late payment of customers or occurrence of fortuitous event that affected your business. In case you need immediate financing, this is where First Circle comes in. Applying is easy as well because everything happens online, which means you don’t have to physically go to their office and brave Metro Manila traffic just to apply for a loan.

As of this writing, First Circle is supported by the Philippine government and is the official finance partner of the Department of Trade and Industry.

Features of First Circle’s Short-Term Business Loan

- Loan Amount: Not specifically disclosed

- Interest Rate: 1.99 to 3.49 percent, depending on the applicant’s overall business profile

- Loan Term: Maximum of six months

- Fixed processing of 1.99 percent, which is computed against the total loan amount

Requirements when Applying for First Circle Business Loan

- Applicant must be a legitimate business owner seeking for business loan

- Two valid government IDs of the business owner

- BIR Certificate of Registration

- DTI or SEC Certificate of Registration

- Proof of Billing

- Purchase Order (PO) or Invoice wherein the amount is minimum of P25,000, which you want to be financed

- In the absence of Purchase Order or Invoice, you can submit Contract Agreement, Notice of Award, Notice to Proceed, Billing Statement, or Delivery Receipt

How to Apply for Business Loan with First Circle:

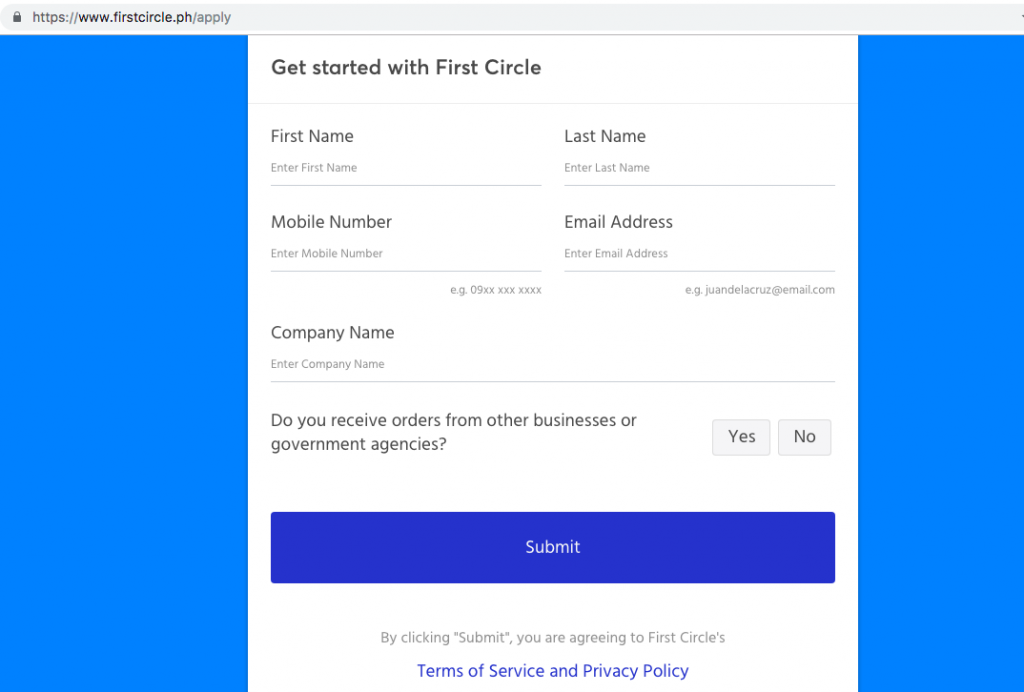

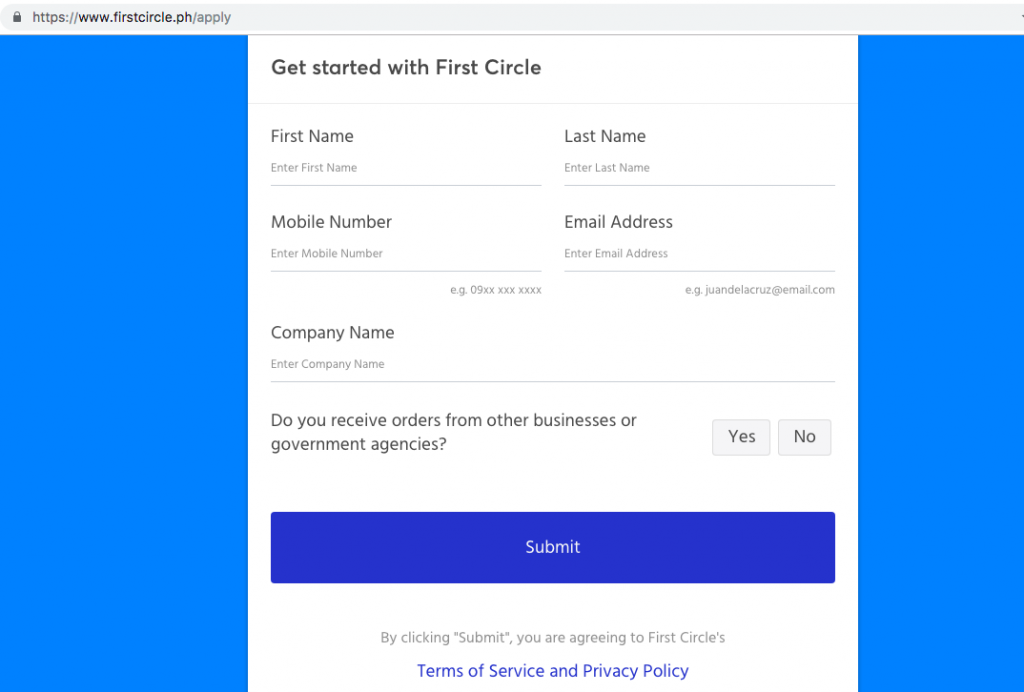

- Create a TrustPass profile by filling out their online application form. You can access the form here. Take note that there are two types of TrustPass profile – Personal and Business. These two are required so that First Circle can verify both your personal and business profiles, which are essential when applying for a loan.

- Once your profiles are approved, submit a Purchase Order or Invoice, depending on what your business needs. Keep in mind that the amount of your purchase order or invoice should be at least P25,000.

- Aside from the Purchase Order or Invoice, submit other documents listed above. First Circle will verify your loan application and documents within 24 to 48 hours.

- If approved, you will be contacted by First Circle representative and ask to accept the offer. Funds will be transferred to your account within 24 to 48 hours from the time you accepted the offer.

- Submit a post-dated check indicating the total loan amount plus interest. This will be picked up by First Circle’s courier on an agreed time and day, and will serve as your payment upon maturity of the loan.

Tips in Applying for First Circle Business Loan

- Make sure that the minimum amount of your PO or Invoice is P25,000.

- You should have a checking account. Mode of payment is via post-dated check, which you will submit to First Circle as soon as you accepted the offer.

- Your credit standing matters. This will increase your chances of not just loan approval but also refinancing.

Now you know who you can run to in case you need additional capital in your business.

Launched publicly in 2016, First Circle is a Philippine-based fin-tech lender that aims to help small-medium business owners with their financing needs. The company understand how difficult it is to apply for a business loan with banks. Plus, not all SMEs have sufficient collateral to cover the amount to be borrowed, which could be a ground for loan rejection.

Launched publicly in 2016, First Circle is a Philippine-based fin-tech lender that aims to help small-medium business owners with their financing needs. The company understand how difficult it is to apply for a business loan with banks. Plus, not all SMEs have sufficient collateral to cover the amount to be borrowed, which could be a ground for loan rejection.